The Flow blockchain network performed a chain rollback to reverse a $3.9 million theft, prompting a key partner to call for a complete halt to network activity. Alex Smirnov, founder of the cross-chain bridge provider deBridge, urged validators to stop processing transactions following the rollback, which was initiated after an exploit on . The controversial move has led to the blockchain stalling and has driven the price of its native FLOW token down significantly.

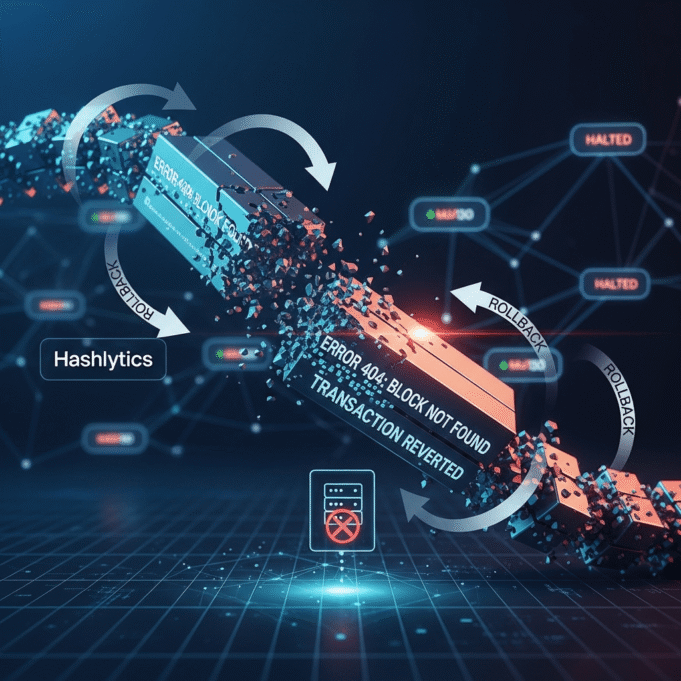

On , an attacker exploited a vulnerability in Flow’s execution layer, siphoning approximately $3.9 million through various cross-chain bridges. In response, the Flow team executed a chain rollback to undo the malicious transactions. However, the network has since remained halted. Data from the block explorer Flowscan shows the blockchain has been stuck at block height 137,385,824 since . The Flow Foundation initially stated the network was expected to restart within four to six hours, a deadline that has since passed.

The decision to roll back a blockchain is contentious because it reverses finalized transactions, undermining the principle of immutability. Smirnov criticized the move as a rushed decision,

stating that ecosystem partners were not properly notified. He argued the rollback could inflict more financial damage than the original exploit, creating systemic issues that affect bridges, custodians, users, and counterparties who acted honestly during the affected window.

This includes exchanges that may struggle to reconcile user deposits and withdrawals. The market reaction was severe, with data from CoinGecko showing the FLOW token’s price fell by 42% after the attack.

The core issue was a security flaw in Flow’s execution layer that allowed the theft to occur. The Flow team chose a rollback as its remediation strategy to recover the stolen funds. However, this action created secondary problems, such as doubled balances for users who bridged assets off the chain during the rollback period. Gabriel Shapiro, general counsel at Delphi Labs, accused the Flow team of creating unbacked assets to cover their asses and expecting bridges and issuers to take the hit.

The incident has raised questions about the network’s decentralization and security protocols.

A detailed remediation plan for users and partners affected by the rollback has not been released. It remains unclear how the Flow Foundation will address the issue of doubled balances for bridge users or compensate partners for the disruption. A firm timeline for the network’s restart has not been provided since the initial estimate lapsed. Dapper Labs, the original creator of the Flow blockchain, has not issued a detailed public statement on its treasury’s involvement or the next steps.

The immediate future of the network depends on the Flow Foundation’s ability to restart the chain and communicate a clear recovery plan. Validators must decide whether to heed Smirnov’s call to halt transaction processing once the network is operational. The event is likely to have a lasting impact on user and developer confidence in the ecosystem, which has secured $725 million in funding from investors like Andreessen Horowitz but holds just $85.5 million in total value locked.

Users with assets on the Flow blockchain or related platforms should monitor official channels from the Flow Foundation and Dapper Labs for updates on the network’s status. It is advisable to verify account balances on exchanges and bridges that support FLOW. Until the network is stable and a remediation plan is announced, users should refrain from attempting to execute new transactions on the Flow blockchain.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates