-0.96%

-0.80%

-0.06%

-0.37%

+0.96%

+1.24%

HBAR‘s recent price action presents a puzzling scenario. Despite a significant influx of $68 million into HBAR-linked ETFs, the token experienced a 3.5% decline. This drop resulted in the breaching of key support levels, leaving analysts questioning the extent to which institutional interest can truly support this particular cryptocurrency.

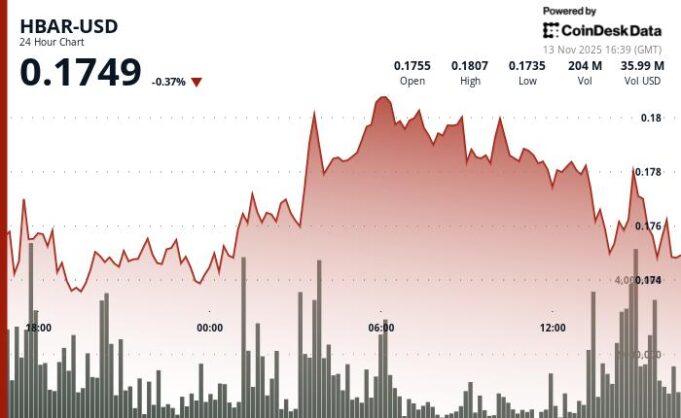

During Wednesday’s trading session, HBAR retreated from $0.1817 to $0.1754. An early morning surge, accompanied by a volume 79% higher than the daily average, encountered resistance at $0.1805, indicating a swift rejection by sellers. The critical question now is whether this dip represents a temporary setback or signals a deeper, underlying weakness in HBAR’s market position.

The contrast between ETF inflows and HBAR’s price performance is striking. The existence of thirteen ETF filings with HBAR exposure suggests that institutions are, at least nominally, confident in the Hedera ecosystem. However, the market’s reaction suggests that these inflows are not immediately translating into sustained buying pressure.

Several factors could explain this divergence. It’s possible that the ETFs are accumulating HBAR gradually over time. Alternatively, the broader crypto market sentiment might be overshadowing the positive news surrounding ETF investments. Regardless of the specific cause, this disconnect between institutional interest and market response warrants careful observation.

From a technical analysis perspective, the current outlook for HBAR appears challenging. Let’s examine some key levels and potential scenarios:

Key Support and Resistance Levels

The immediate support level to monitor is $0.1740. A break below this level could potentially trigger further downside movement. Conversely, resistance is firmly established at $0.1805, a level that HBAR needs to overcome to regain bullish momentum.

Volume Analysis

The morning spike in trading volume saw 125.8 million shares traded. However, the lack of sustained upward movement suggests that the initial enthusiasm was short-lived and did not translate into lasting buying pressure.

Chart Patterns

The formation of consecutive lower highs on HBAR’s price chart paints a bearish picture, indicating continued downward pressure and a lack of sustained buying interest.

Price Targets and Risk/Reward Assessment

Immediate downside targets are situated in the $0.1720-$0.1700 range. Upside potential is currently capped by the resistance level at $0.1805. Traders should carefully assess the risk/reward ratio before initiating any positions.

The Canary HBAR ETF: A Sign of Long-Term Confidence?

The Canary HBAR ETF’s accumulation of $68 million over six trading sessions is undoubtedly a positive development. It suggests a degree of long-term confidence in the Hedera network and its potential applications. However, even positive indicators should be viewed within the context of overall market conditions.

Whether this institutional interest can effectively counter the prevailing bearish sentiment remains to be seen. The trading activity over the next few sessions will be crucial in determining HBAR’s short-term trajectory and whether a sustained rebound is possible.

HBAR’s future performance depends on several critical factors. These include continued institutional support, a general improvement in overall market sentiment, and, importantly, a decisive break above the $0.1805 resistance level. If these conditions align favorably, a rebound is certainly within the realm of possibility. However, should the current downward trend persist, HBAR could face further downside pressure. The market’s current signals are being closely monitored by HBAR investors as they try to anticipate the token’s next move.