-0.96%

-0.80%

+3.10%

-0.15%

+0.03%

+0.47%

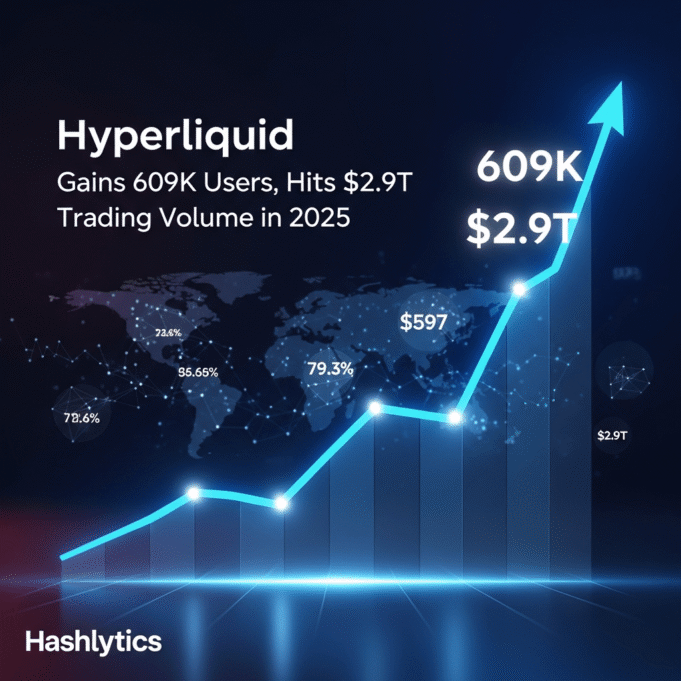

Hyperliquid, a decentralized derivatives platform, reported significant growth in , adding over 609,000 new users and reaching a total trading volume of $2.9 trillion. This expansion highlights a surge in decentralized finance (DeFi) adoption and increased demand for decentralized trading solutions.

In , Hyperliquid onboarded more than 609,000 new traders, expanding its presence across both retail and institutional markets. The platform’s total trading volume for the year reached $2.9 trillion, with approximately $199 billion attributed to executed trades. Net inflows during this period totalled $3.8 billion, reflecting robust capital movement into the platform. Hyperliquid concluded with $4.1 billion in total value locked (TVL) and generated an estimated $844 million in revenue.

The reported $2.9 trillion in total trading volume positions Hyperliquid among leading decentralized trading platforms globally. This volume, alongside the $3.8 billion in net deposits, underscores sustained interest in decentralized derivatives. The platform’s financial performance also included approximately $844 million in revenue, which the report indicates makes it one of the more profitable decentralized exchanges within the ecosystem. The increase to $4.1 billion in total value locked by the end of further indicates user confidence in the platform’s ability to manage substantial capital in a decentralized environment.

The reported growth is attributed to several factors, including broader adoption of decentralized finance and a growing demand for decentralized derivatives. According to ASXN Data, Hyperliquid observed steady user base growth throughout the year, supported by enhancements to its interface, improvements in trade execution speed, and a focus on security and transparency. The platform also cited offering low fees, faster execution, and a wide range of derivative products as contributors to its appeal among traders seeking non-custodial alternatives.

Specific details regarding the quarterly breakdown of user acquisition, trading volumes, or revenue throughout are not available in the provided information. The exact timeline for potential new product launches or feature updates following this growth period is also not specified.

The reported momentum positions Hyperliquid as a significant entity within the decentralized exchange landscape as the market transitions into . Continued growth in user base and trading activity could further solidify its role in the evolving decentralized derivatives sector, potentially influencing future developments in platform offerings and market competition.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates