-0.96%

-0.80%

+0.58%

-15.08%

+3.11%

-1.28%

Nigeria, a nation with a burgeoning crypto scene, stands at a critical juncture. The Parliament is actively engaging with crypto firms to develop new regulations, a move that holds the potential to unlock significant economic opportunities or inadvertently hinder innovation. The stakes are considerable, and the global community is closely monitoring the situation.

The House of Representatives Ad-Hoc Committee, responsible for assessing the economic, regulatory, and security implications of cryptocurrency and Point-of-Sale (POS) operations, recently held a crucial meeting. Regulators and Virtual Assets Service Providers (VASPs), represented by the Stakeholders in Blockchain Technology Association of Nigeria (SiBAN), participated in productive discussions, indicating a proactive stance towards navigating the complexities of digital finance.

Hon. Olufemi Bamisile, Chairman of the House Ad-hoc Committee on Cryptocurrency, has emerged as a strong proponent of revising the Securities and Exchange Commission’s (SEC) minimum capital requirement for crypto exchanges. The current requirement of ₦1 billion is widely perceived as excessively restrictive.

Bamisile has argued that regulations must protect investors while simultaneously fostering innovation. He emphasized that Nigeria’s capital requirements exceed global standards, including the European Union’s MiCA framework, thereby creating an unlevel playing field.

Furthermore, Bamisile highlighted an important inconsistency: most Nigerian crypto firms do not actually hold customer funds; they primarily manage the underlying technology. Imposing the same stringent capital and insurance standards on these tech-focused firms as on custodial entities appears both unfair and counterproductive.

“Regulations should open doors, not close them. High barriers…would simply export our brightest minds as young entrepreneurs register their businesses abroad, resulting in lost jobs, skills, and tax revenue for Nigeria.” – Hon. Olufemi Bamisile

The Committee’s recommendations highlight a “Nigeria first” licensing approach using a tiered system. This innovative model enables firms with smaller capital exposure to operate under mandatory mentorship and joint compliance tracking between the SEC and the Central Bank of Nigeria (CBN). As these firms mature and demonstrate their capabilities, they can advance to higher tiers with greater responsibilities.

This strategy aims to stimulate local innovation, build confidence in the system, and align with the President’s vision of inclusive economic empowerment. It represents a strategic investment in nurturing domestic talent and preventing a brain drain.

SiBAN, as the primary self-regulatory body for the sector, played a key role in the session. The association presented a comprehensive memorandum to the Committee, acknowledging the House for its timely intervention.

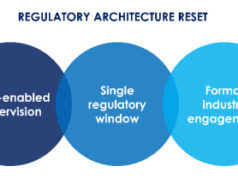

SiBAN recognized Nigeria’s leading position in digital asset adoption, driven by a young and tech-savvy population. However, it emphasized that a fragmented regulatory environment, characterized by overlapping jurisdictions among the CBN, SEC, and other agencies, is impeding the industry’s growth. A cohesive, risk-based framework is urgently needed to promote growth and address issues such as fraud and money laundering.

Key Proposals from SiBAN

SiBAN’s proposals include several key reforms designed to foster a more robust and sustainable digital asset ecosystem:

- Enactment of an Act for Blockchain Technology and Digital Assets to define and categorize digital assets and recognize blockchain as foundational infrastructure.

- Establishment of a National Council on Blockchain & Digital Assets, situated under the Presidency, to harmonize cross-agency standards and manage a national multi-sector sandbox.

- Implementation of a tiered licensing framework to differentiate between high-risk custodial services and lower-risk infrastructure providers.

- Local content requirements and policy incentives to protect Nigerian-owned firms from foreign dominance.

- Mandatory consumer protection measures, including KYC, AML/CFT/CPF compliance, and dispute resolution mechanisms.

SiBAN believes that these comprehensive reforms would not only align Nigeria with global benchmarks, such as the European Union’s Markets in Crypto-Assets Regulation (MiCA) and UAE’s Virtual Assets Regulatory Authority (VARA), but also unlock significant national benefits, including regulatory certainty, enhanced financial inclusion, reduced fraud, and increased job creation.

The Nigerian Parliament’s engagement with crypto stakeholders marks a significant turning point. The resulting regulations will determine whether Nigeria cultivates a thriving ecosystem or inadvertently stifles innovation. Nigeria’s approach will undoubtedly serve as a model for other nations grappling with the rise of digital assets, and the outcome could reshape the future of finance across the continent.