-0.96%

-0.80%

+3.31%

-1.54%

+4.41%

+3.27%

Buckle up, crypto enthusiasts! We’re about to take a wild ride through North America‘s digital asset landscape, where the only constant is change. It’s 2025, and the continent has become a veritable crypto rollercoaster, with more twists and turns than a season finale of “Succession.” Let’s dive into the juicy details of this financial frontier.

North America’s Crypto Surge: Key 2025 Adoption Trends Revealed

Picture this: North America, the land of opportunity, is now also the land of cryptocurrency. We’re talking a whopping 26% of all global crypto transaction activity happening right here. It’s like the continent decided to go all-in on a high-stakes poker game, and boy, are the chips flying!

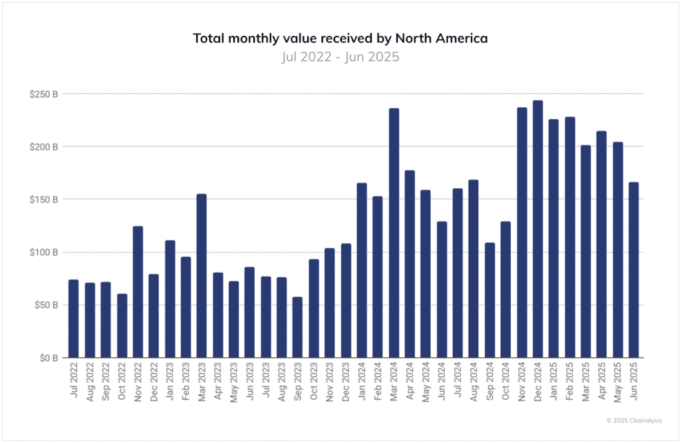

In just one year, from July 2024 to June 2025, North America saw $2.3 trillion in crypto transactions. That’s not just big money; that’s “I-can’t-believe-it’s-not-butter” levels of smooth transacting. December 2024 was the pinnacle, with $244 billion changing digital hands faster than you can say “blockchain.”

But what sparked this crypto fever? Well, imagine if the Avengers assembled, but instead of superheroes, it was a dream team of market catalysts:

- Trump’s triumphant return to the White House (love him or hate him, markets love certainty)

- A more crypto-friendly regulatory stance (goodbye red tape, hello green lights)

- Monetary easing that made risk appetites grow three sizes that day

- Institutional players joining the party like it’s 1999 (or should we say 2025?)

But here’s where it gets interesting. North America isn’t just participating; it’s leading the charge with style. The region’s crypto activity is more volatile than a teenager’s mood swings, with monthly growth rates bouncing between a 35% decline and an 84% spike. It’s like watching a financial earthquake in real-time!

Why the wild ride? Two words: institutional muscle. While the rest of the world is steadily adopting crypto for everyday use, North America is where the big boys come to play. We’re talking 45% of all transaction value happening in transfers over $10 million. That’s not just whale watching; that’s spotting entire pods of financial leviathans!

The Rise of the Crypto Titans: ETFs and Tokenized Treasuries

Hold onto your hardware wallets, folks, because the traditional finance world is crashing the crypto party in style. Bitcoin ETFs have exploded onto the scene like a financial Godzilla, with global assets under management (AUM) reaching a mind-boggling $179.5 billion. That’s not just big; that’s “we’re gonna need a bigger blockchain” big.

But wait, there’s more! Tokenized treasuries are the new cool kids on the block. These digital representations of good ol’ U.S. government debt have quadrupled in AUM, jumping from $2 billion to $7 billion faster than you can say “yield curve.” It’s like someone took the stodgy world of treasury bonds and gave it a Silicon Valley makeover.

And let’s not forget about stablecoins, the unsung heroes of the crypto world. These digital dollars are moving trillions each month, proving that sometimes, stability is the most revolutionary thing of all. It’s like the U.S. dollar got a passport and decided to go on a worldwide adventure, minus the jet lag.

So, what’s the takeaway from all this crypto craziness? North America isn’t just adopting cryptocurrency; it’s redefining it. From institutional giants to everyday traders, the continent is embracing digital assets with the enthusiasm of a kid in a candy store – if that candy store accepted Bitcoin.

As we look to the future, one thing’s clear: the crypto revolution isn’t just coming; it’s here, it’s loud, and it’s got a distinctly North American accent. So whether you’re a seasoned trader or a curious newbie, buckle up and enjoy the ride. The future of finance is being written right here, right now – and it’s anything but boring!