-0.96%

-0.80%

-0.11%

-3.19%

+1.44%

+0.63%

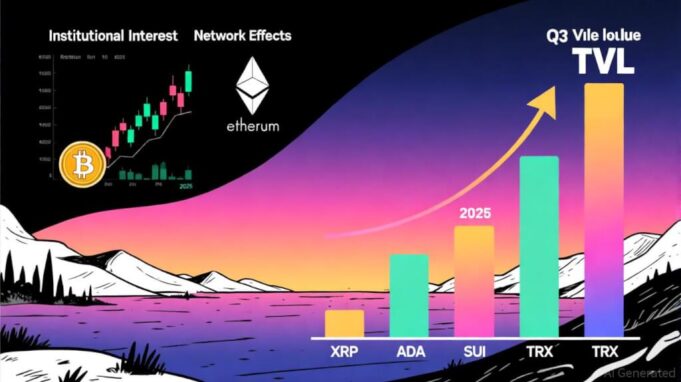

The cryptocurrency landscape is undergoing a dramatic transformation as we approach 2025, with several altcoins positioned to reshape the digital asset ecosystem. While Bitcoin and Ethereum continue their reign as market leaders, a new wave of innovative projects is emerging to solve real-world challenges and capture institutional interest.

Top Altcoins Set to Dominate Crypto Markets in 2025

The evolution of crypto markets has reached a fascinating inflection point where utility and innovation are finally overtaking pure speculation. Let’s dive into the most promising altcoins that are redefining the future of digital finance.

XRP

XRP stands at the forefront of the cross-border payments revolution. After emerging victorious from its regulatory battles, Ripple’s native token has become the go-to solution for banks and financial institutions looking to modernize their payment infrastructure. XRP‘s lightning-fast settlement times and negligible fees have caught the attention of several central banks exploring CBDCs.

ADA

ADA has evolved beyond its academic roots to become a powerhouse in the DeFi space. Cardano’s methodical approach to development is finally paying dividends, with its ecosystem experiencing explosive growth in decentralized applications. The platform’s unique ability to bridge Bitcoin liquidity with DeFi protocols has created a compelling value proposition for institutional investors.

SUI

The rise of SUI represents a new paradigm in blockchain scalability. Its revolutionary parallel processing architecture has captured the attention of enterprise users, particularly in the gaming and NFT sectors. With transaction speeds exceeding 100,000 TPS, Sui is positioning itself as the backbone for next-generation Web3 applications.

OM

Meanwhile, OM token’s meteoric rise reflects growing institutional appetite for Real World Assets (RWA) on the blockchain. Mantra’s platform is bridging the gap between traditional finance and DeFi, tokenizing everything from real estate to commodity futures. This convergence of TradFi and DeFi could unlock trillions in untapped liquidity.

The Perfect Storm: Technology, Regulation, and Adoption

What makes 2025 particularly exciting is the convergence of three critical factors. First, technological breakthroughs in scalability and interoperability are finally making mass adoption feasible. Second, regulatory clarity is providing institutions the confidence to deploy capital at scale. Third, real-world use cases are driving organic demand beyond speculative trading.

Looking ahead, analysts project the total altcoin market capitalization could reach $5 trillion by 2027. This growth will likely be driven by institutional adoption, with regulated investment products like ETFs making digital assets accessible to traditional portfolio managers.

Investment Strategy and Risk Considerations

While the potential returns are attractive, investors should approach the altcoin market with a balanced strategy. Diversification across different use cases – payments (XRP), smart contracts (ADA), infrastructure (SUI), and RWA (OM) – can help mitigate project-specific risks while maintaining exposure to the sector’s growth.

The key to success in the 2025 crypto market will be focusing on projects with strong fundamentals:

– Clear use cases solving real problems – Active developer communities – Growing user adoption metrics – Sustainable tokenomics – Institutional backing

As Bitcoin and Ethereum mature, the next wave of crypto innovation will likely come from these carefully selected altcoins. Their success will depend not just on technological superiority, but on their ability to bridge the gap between blockchain potential and real-world utility.

The future of crypto is no longer about replacing traditional finance – it’s about enhancing it. The winners of 2025 will be the projects that best facilitate this transformation while maintaining the core values of decentralization and accessibility that made cryptocurrency revolutionary in the first place.