Financial fraud poses a persistent challenge, often outpacing the capabilities of traditional detection systems. A new framework addresses this issue by integrating graph databases with real-time machine learning, offering a substantial upgrade to fraud detection and risk control within financial institutions.

Framework Boosts Financial Security with Real-Time ML

This framework represents a significant advancement, moving beyond incremental improvements to offer a paradigm shift in financial security. By leveraging graph databases to model intricate relationships and machine learning to identify concealed patterns, the framework enables financial institutions to enhance fraud detection, credit evaluation, and anti-money laundering efforts with superior efficiency and accuracy.

Why This Framework Is a Game-Changer

The framework’s revolutionary nature stems from its core capabilities:

* Enhanced Detection Accuracy: It identifies fraudulent activities that traditional systems often overlook.

* Increased Processing Speed: It analyzes massive transaction datasets in real-time.

* Improved System Scalability: It adapts to the growing demands of digital finance.

Step-by-Step Guide to Understanding the Framework

The framework operates through a series of key steps:

- Building the Foundation: Graph Databases and Machine Learning

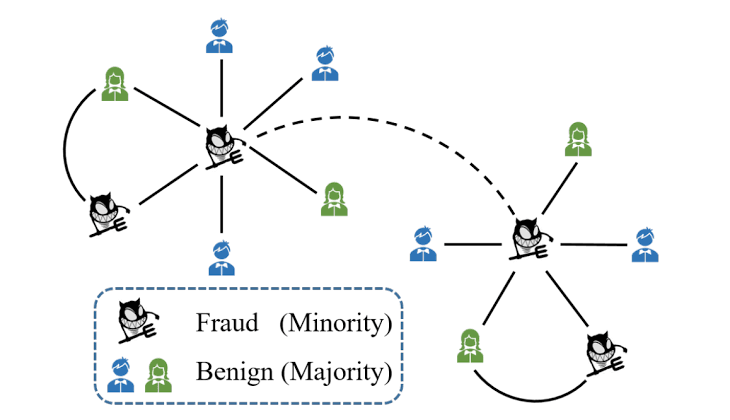

The framework utilizes graph databases to model complex relationships between users, transactions, and accounts. Machine learning algorithms then analyze these relationships to identify suspicious patterns, creating a comprehensive view of potential fraudulent networks.

- Uncovering Fraudulent Communities

Graph convolutional neural networks model customer relationships, transaction paths, and guarantee networks. By calculating fraud probability scores, the system identifies anomalous fund flow patterns, such as cross-account money laundering, effectively predicting fraudulent activities.

- Real-Time Machine Learning for Multi-Channel Fraud

The framework processes massive transaction data streams in real-time, using adaptive learning mechanisms and dynamic threshold adjustments. This ensures that the system can respond quickly to new and evolving fraud schemes, providing an adaptable defense against emerging threats.

- Feature Engineering and Real-Time Risk Assessment

A reusable feature store integrates vendor signals, risk service outputs, network telemetry, and temporal velocity patterns. This comprehensive approach enables consistent performance across multiple fraud detection models, providing a detailed overview for identifying fraudulent activities.

Practical Examples: Where Does This Shine?

The framework offers tangible benefits in several key areas:

* Detecting Circular Fraud Schemes: It identifies complex patterns of money movement designed to obscure the origin of funds.

* Improving Credit Evaluation: It assesses the creditworthiness of individuals and businesses based on their network relationships.

* Combating Anti-Money Laundering: It identifies and prevents the flow of illicit funds through the financial system.

Troubleshooting: Common Hurdles and How to Overcome Them

Implementing the framework may present certain challenges:

* Problem: Data quality issues affecting model accuracy.

Solution: Implement robust data cleaning and standardization pipelines.

* Problem: Difficulty in scaling the system to handle massive data volumes.

Solution: Utilize cloud-based infrastructure and distributed computing techniques.

* Problem: Model drift leading to decreased performance over time.

Solution: Regularly retrain models with new data and monitor performance metrics.

Best Practices: Tips for Maximum Impact

To maximize the framework’s effectiveness, consider the following best practices:

* Prioritize Data Quality: Ensure that your data is accurate, complete, and consistent.

* Embrace Real-Time Processing: Process transaction data in real-time to detect fraud as it happens.

* Continuously Monitor and Adapt: Regularly evaluate the performance of your models and adjust them as needed.

Ready to Take the Next Step?

This framework marks a significant advancement in financial security, offering theoretical insights and practical guidance for institutions seeking to protect consumers and maintain ecosystem integrity. Further exploration of graph databases, machine learning, and financial fraud detection is encouraged.

Contact Info:

Name: Xuanrui Zhang

Email: [Send Email](https://send.releasecontact.com/89172131)

Organization: Xuanrui Zhang

Release ID: 89172131

For any deficiencies, problems, or concerns regarding the information presented, please notify [email protected]. The team is committed to addressing concerns within 8 hours and taking necessary actions to rectify any identified issues or facilitate the removal process. Providing accurate and trustworthy information is of utmost importance.