+4.86%

+7.11%

-0.69%

+7.03%

-3.67%

+3.96%

Billions Network has disclosed the tokenomics for its $BILL token, marking a significant milestone in its roadmap. Following an August announcement that the token generation event (TGE) would occur within the coming months, this release provides clarity on how the token will function within the ecosystem designed to rebuild trust in online spaces.

The Vision: Rebuilding Digital Trust

Billions Network addresses critical issues like bots and fake identities that have eroded reliability on the internet. The platform is backed by prominent investors including Coinbase Ventures and Polychain Capital, who contributed to the project’s $30 million fundraising round. With this foundation in place, the $BILL token serves as the core utility mechanism, designed to support verification processes, reward participation, and ensure the network’s long-term sustainability through practical economic models.

Token Basics

At its core, $BILL is an ERC-20 utility token built on an Ethereum Layer-2 solution, which allows for efficient transactions while maintaining compatibility with the broader Ethereum ecosystem. The total supply is capped at 10 billion tokens, with no possibility of inflation, ensuring a fixed quantity that cannot increase over time.

Upon launch at the TGE, approximately 23% of the supply — or 2.3 billion tokens — will enter circulation, providing sufficient liquidity for early operations and community engagement without overwhelming the market.

The design emphasizes a usage-driven approach, where increased network activity leads to greater token value through built-in mechanisms. The tokenomics tie directly to real-world applications, such as verifying identities and issuing credentials. Network fees generated from these activities fund automated processes that reduce the circulating supply over time, creating a cycle where more usage strengthens the overall system. This structure positions $BILL as a tool for practical utility, aligning incentives for users, contributors, and partners.

Allocation Breakdown

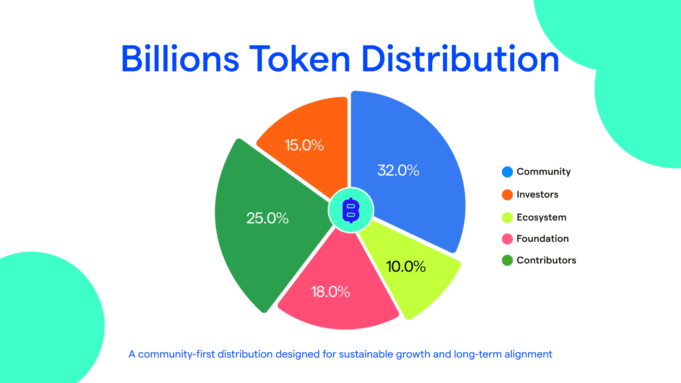

The allocation of $BILL reflects a priority on community involvement, with the largest share dedicated to those who actively build and expand the network. A total of 7.88% unlocks at the TGE, while the rest distributes gradually over four years, focusing on front-loaded rewards during the initial growth phase.

Distribution Structure:

- Community (32%): Allocated for ongoing rewards, staking opportunities, hackathons, and other growth initiatives that encourage widespread participation.

- Contributors (25%): Reserved for the team and builders, with a one-year cliff followed by a vesting term commitment to ensure long-term alignment.

- Foundation Reserves (18%): Used for liquidity provision, operational needs, and maintaining stability, released over a structured four-year period.

- Investors (15%): Designated for strategic backers, featuring a 12-month cliff and four-year vesting to align interests with network success.

- Ecosystem Fund (10%): Supports partnerships and integrations, with 5% unlocked at the TGE to facilitate early collaborations.

These figures align with the project’s white paper, which was notified to the Spanish National Securities Market Commission (CNMV), adding a layer of regulatory transparency to the distribution plan.

Key Utilities and Mechanisms

Core Use Cases

$BILL’s utilities extend across several areas, each contributing to a self-sustaining ecosystem where verification translates into tangible value. Users can pay for credential fees and verify humans or AI agents, gaining access to network features. Those who use $BILL for these payments receive discounts of 10 – 15%, which encourages adoption and generates consistent demand, particularly for integrators handling high volumes.

Deflationary Model

A standout feature is the deflationary model, where real network activity — such as verifications and credential issuances — produces fee revenue that funds automated buybacks. These buybacks permanently remove tokens from circulation, reducing supply as usage grows. This creates a positive feedback loop: higher activity leads to more revenue, which in turn supports further reductions in supply and potential value appreciation for holders.

Staking and Governance

Staking plays a central role as well. By staking $BILL, participants can demonstrate credibility, earn shares of protocol revenue, and unlock higher reputation levels. This appeals to a broad range of stakeholders, including individual users, credential attesters, vendors, and AI agents, fostering organic demand. In future phases, the token will also enable governance, allowing holders to vote on aspects like funding allocations, parameter adjustments, and trust-related decisions.

Ecosystem Flywheel

Additionally, $BILL facilitates ecosystem rewards for contributions, referrals, and partner incentives, helping to expand the network. The overall flywheel effect — where network growth spurs more verification activity, generating revenue for buybacks and supply reduction — underpins the model. A key differentiator here is the reusable nature of credentials, which can be applied repeatedly across the ecosystem without additional costs, creating ongoing revenue streams that support sustainability.

Supply Release Schedule

To promote stability and protect against market volatility, the supply release follows a gradual timeline tied to network milestones. This approach rewards early adopters while minimizing risks like sudden supply increases.

Four-Year Distribution Timeline:

- Launch (TGE): Approximately 23% circulating, supporting community programs, ecosystem expansion, and foundational operations.

- End of Year 1: Reaches about 45%, as the network builds traction and initial community distributions occur.

- Year 2: Increases to roughly 62%, with the start of unlocks for investors and contributors.

- Year 3: Climbs to around 83%, coinciding with network maturation and fuller ecosystem activation.

- Year 4: Achieves 100% circulation, completing the distribution in alignment with long-term goals.

This measured rollout helps maintain healthy liquidity and shields participants from dilution, ensuring that growth remains steady and predictable.

Final Thoughts

With the tokenomics now public, Billions Network appears positioned for its upcoming TGE, building on the momentum from its August update. The emphasis on proof of uniqueness — where verified individuals act as nodes in a trust-based economy —suggests a framework that values contribution over extraction.

The project has already attracted over 900,000 verified users worldwide and established partnerships with major institutions. Participants who verify identities, stake tokens, or engage in other activities stand to benefit as the system expands, potentially creating a more reliable online environment for human-AI collaboration.

As the internet evolves to accommodate both human users and AI agents, Billions Network’s approach to privacy-first verification using zero-knowledge proofs and mobile-first authentication — without invasive biometrics — positions it uniquely in the emerging digital identity landscape.