The disruption originated from AWS’s northern Virginia cluster (US-EAST-1), caused by DNS resolution issues affecting DynamoDB endpoints. This marked the third outage in five years for AWS’s largest data center, emphasizing the importance of exploring alternative cloud infrastructure providers.

Top 5 AWS Alternatives for 2025

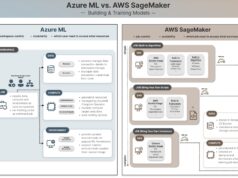

1. Microsoft Azure (MSFT)

Market share: ~22% | Best for: Microsoft-centric enterprises and hybrid cloud deployments

Microsoft Azure ranks second globally, offering seamless integration with Microsoft 365, Windows Server, and enterprise IT environments. Azure excels in hybrid cloud capabilities through Azure Arc and provides robust AI/ML tools including Azure OpenAI and ML Studio. Q4 2025 results showed Azure cloud services grew 39% year-over-year, with Microsoft Cloud revenue reaching $46.7 billion.

2. Google Cloud Platform (GCP)

Market share: ~12% | Best for: Data-heavy workloads and AI-first teams

Google Cloud Platform excels in data analytics and Kubernetes leadership, offering Vertex AI, TPU v5p processors, and Duet AI tools. GCP provides competitive pricing with high-performance computing capabilities and multi-region redundancy. Q2 2025 revenue surged 32% to $13.6 billion, with annual run-rate exceeding $50 billion.

3. Oracle Cloud Infrastructure (OCI)

Market share: <5% | Best for: Enterprise databases and regulated workloads

Oracle Cloud Infrastructure offers aggressive price-performance optimized for databases, ERP, and mission-critical applications. The platform supports diverse open-source technologies including Kubernetes, Spark, and Terraform. Oracle’s new AI Database service enables direct LLM integration with ChatGPT, Gemini, and Grok. FY2026 Q1 showed cloud revenue jumping 28% to $7.2 billion.

4. IBM Cloud

Market share: ~2% | Best for: Highly regulated industries requiring compliance

IBM Cloud focuses on enterprise-grade security and AI-driven solutions, featuring the Watsonx platform and strong Red Hat OpenShift integration. IBM Cloud Satellite enables hybrid deployments across any environment. Q2 2025 results showed infrastructure segment growth of 21%, with Hybrid Cloud revenue surging 16%.

5. Alibaba Cloud

Market share: ~4% globally, ~35% in China | Best for: Asia-Pacific expansion and cost efficiency

As Asia’s largest cloud provider, Alibaba Cloud offers competitive pricing with robust networking and CDN capabilities. The platform features Qwen AI models and innovative Aegaeon inference pooling, which reportedly reduces GPU requirements by 82%. Q2 2025 Cloud Intelligence Group revenue grew 26% to $4.6 billion, driven by AI-related products maintaining triple-digit growth.

Key Takeaway

While AWS dominates with ~33% market share and generated $10.2 billion in Q2 2025 operating income, recent outages demonstrate the risk of single-provider dependency. Each alternative offers unique strengths—whether Microsoft’s enterprise integration, Google’s data analytics prowess, Oracle’s database optimization, IBM’s compliance focus, or Alibaba’s Asia-Pacific dominance.

Diversifying cloud infrastructure ensures business continuity, reduces vendor lock-in, and provides access to specialized capabilities tailored to specific workloads and geographic requirements.