-2.28%

-3.15%

-5.64%

+0.00%

+7.55%

-7.85%

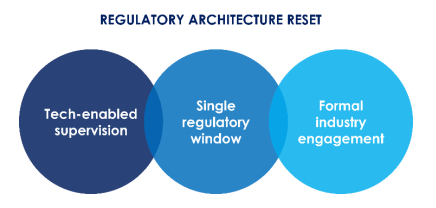

Nigeria’s Central Bank (CBN) released its Fintech Strategy Report on February 7, 2026, outlining the first comprehensive regulatory overhaul since 2013. The framework introduces ten structural reforms designed to address licensing bottlenecks, regulatory fragmentation, and infrastructure gaps that have constrained Nigeria’s fintech ecosystem despite its status as Africa’s largest by transaction volume.

Strategic Priorities

The report establishes a structured engagement model through a permanent Fintech Engagement Forum featuring a Standing Advisory Council and quarterly policy sessions. This formalization of industry-regulator dialogue replaces ad-hoc consultations that previously characterized CBN’s approach to fintech supervision.

A unified digital portal, the Smart Licensing & Supervisory Gateway (SLSG), will consolidate licensing and reporting across multiple regulatory agencies. The platform embeds Supervisory Technology (SupTech) for real-time monitoring, addressing complaints from operators who currently navigate separate approval processes with the CBN, Securities and Exchange Commission, and Nigerian Communications Commission for overlapping activities like payments, digital securities, and telecommunications-based financial services.

The regulatory sandbox will expand beyond its current pilot-stage limitations through “Sandbox 2.0,” which introduces defined pathways from experimental testing to full market authorization. The CBN identified AI applications, embedded finance, and cross-border payments as priority testing areas, coordinating with existing sandboxes operated by other regulators to prevent duplicative approval requirements.

Market Structure Reforms

The strategy proposes a consolidated digital-bank license that would allow new entrants to offer credit and deposit products with appropriate capital and risk management requirements. This represents a policy shift from expanding Payment Service Bank (PSB) permissions, which the CBN determined insufficient for addressing credit access gaps in underserved markets. The consolidated license aims to attract technology-first institutions that can deploy alternative credit scoring and distribution models in rural areas where traditional banks maintain limited presence.

Open Banking implementation will accelerate through an Open Finance Lab conducting supervised pilots before full market deployment. The CBN committed to publishing a public implementation roadmap with clear dispute resolution mechanisms, responding to industry concerns that ambiguous liability frameworks have deterred data-sharing initiatives despite technical standards published in 2024.

Infrastructure Modernization

The report addresses persistent friction in digital identity verification by proposing API-based access improvements for Bank Verification Number (BVN) and National Identification Number (NIN) systems. Current verification processes involve manual checks and batch processing that create onboarding delays, particularly for mobile-first services targeting populations without existing banking relationships. The CBN plans to strengthen BVN-NIN interoperability and establish system redundancy to address outages that have disrupted fintech operations.

Credit infrastructure reforms target the fragmented reporting ecosystem where multiple credit bureaus operate with limited data interoperability. The strategy proposes shared compliance utilities potentially delivered through a Compliance-as-a-Service (CaaS) model, reducing redundant due diligence costs while enabling real-time fraud intelligence sharing across institutions.

A voluntary Fintech Trust & Safety Charter will establish baseline standards for data protection, cybersecurity, fair competition, and consumer redress. Participants will appear on a public registry, with adherence potentially qualifying firms for expedited access to pilot programs and regulatory approval tracks.

Regional Integration

The CBN will pilot mutual license recognition agreements with Ghana, Kenya, and Senegal to facilitate cross-border expansion for Nigerian fintechs. The initiative seeks deeper regulatory alignment on Know Your Customer (KYC) requirements and payment standards through the Economic Community of West African States (ECOWAS), addressing current barriers where firms must secure separate licenses and maintain duplicative compliance infrastructure in each market.

Nigeria’s positioning as a hub for responsible AI in finance follows a “test-then-codify” approach where regulatory sandbox learnings inform outcome-based rules for AI applications in fraud detection, credit scoring, and risk management. This contrasts with jurisdictions that have imposed prescriptive AI regulations before widespread commercial deployment.

Implementation Timeline

The CBN structured rollout across three phases over 18 months.

- Phase 1 (0-3 months) establishes the Fintech Engagement Forum, publishes the Open Banking roadmap, and begins technical scoping for the Single Regulatory Window.

- Phase 2 (3-9 months) launches Sandbox 2.0’s first cohort, operationalizes the Fintech Credit Guarantee Window, and initiates bilateral regulatory passporting discussions.

- Phase 3 (9-18 months) formalizes the Advisory Council, deploys the public Regulatory Engagement Platform, and embeds supervisory analytics tools.

The strategy addresses structural issues that have created regulatory uncertainty despite Nigeria’s fintech sector processing over $2 trillion in annual transaction value. Ambiguous compliance requirements, lengthy approval timelines, and fragmented oversight have pushed some operators toward informal arrangements or offshore structuring to avoid regulatory complexity.

The consolidated licensing framework and unified portal could reduce time-to-market for new products while lowering compliance overhead for established players managing multiple regulatory relationships. However, execution risk remains significant given Nigeria’s history of ambitious policy frameworks that encounter implementation challenges related to funding, inter-agency coordination, and technology infrastructure reliability.

For operators, the immediate focus centers on Open Banking standards finalization, digital identity API access improvements, and Sandbox 2.0 application criteria. The 18-month timeline suggests rapid policy development, requiring firms to align internal compliance systems, data governance frameworks, and supervisory reporting capabilities with emerging requirements.

The strategy’s success depends on the CBN’s ability to deliver promised infrastructure upgrades, maintain consistent policy interpretation across regional offices, and coordinate effectively with other regulatory agencies whose cooperation is essential for the Single Regulatory Window’s functionality. Industry stakeholders will watch Phase 1 execution closely as an indicator of the CBN’s commitment to the ambitious transformation agenda outlined in the Fintech Strategy Report.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates