+3.26%

+5.96%

+6.11%

-3.40%

+0.39%

+0.72%

Wall Street’s often a fickle beast, underestimating potential and overhyping the flavor of the month. But sometimes, a voice cuts through the noise, offering a perspective that’s both insightful and, dare we say, profitable. KeyBanc, led by the astute Jackson Ader, is making waves with a bold prediction: the market is sleeping on Oracle’s cloud growth potential. And they’re not just whispering sweet nothings; they’re backing it up with data.

Oracle (ORCL) Cloud Growth: KeyBanc’s Bullish Prediction Revealed

The heart of KeyBanc’s argument revolves around capital expenditure (capex) conversion rates. In simpler terms, how much extra revenue does each dollar spent on cloud infrastructure generate? Historically, cloud titans could squeeze roughly 75 cents of revenue from every dollar invested. But the AI revolution, with its insatiable hunger for GPU power, has thrown a wrench into the equation. We’ve gone from efficient CPU-based systems to monstrous, GPU-laden data centers that demand massive upfront investments. This shift has caused conversion rates to plummet, dropping from a peak of nearly 87% in 2021 to below 50% across the board. It’s like buying a fleet of gas-guzzling Hummers when everyone else is on electric scooters – the initial cost is huge, and the short-term payoff is questionable.

But here’s where Oracle (ORCL) potentially shines. While giants like Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure are expected to see their conversion rates dwindle (think a fall from grace from 111% and 93% in 2016 to a projected 35% and 36% this year), KeyBanc believes Oracle is poised to outperform. Their 2025 estimate for Oracle sits at a comparatively healthy 47%. It’s like Oracle has been secretly building a hyper-efficient, AI-powered scooter factory while everyone else was distracted by their Hummer collections. But what about the longer term?

Why Oracle Might Just Be the Dark Horse in the Cloud Race

Looking ahead to 2026-28, consensus forecasts anticipate Oracle’s capex conversion to climb to 42%, 63%, and eventually 97%. Meanwhile, AWS and Azure are expected to languish between 30% and 34%. KeyBanc’s own estimates are a tad more conservative (28%, 39%, and 70%), but still paint a significantly brighter picture for Oracle. Why the discrepancy? KeyBanc believes Oracle is investing more heavily in cloud infrastructure than other analysts anticipate, fueled by a surge in lease obligations. It’s a bold bet, but one that could pay off handsomely if their predictions hold true.

Think of it this way: AWS and Azure were early to the cloud game, building their empires on CPU-based infrastructure. Now, they’re scrambling to adapt to the GPU-powered AI landscape, retrofitting their existing systems. Oracle, on the other hand, might be strategically building from the ground up, designing its infrastructure specifically for the demands of AI workloads. This could give them a significant efficiency advantage in the long run. “Oracle’s late entry into the cloud market could actually be a blessing in disguise,” suggests hypothetical cloud infrastructure analyst, Dr. Anya Sharma. “They’ve had the benefit of learning from the mistakes of others and designing a more optimized system from the outset.”

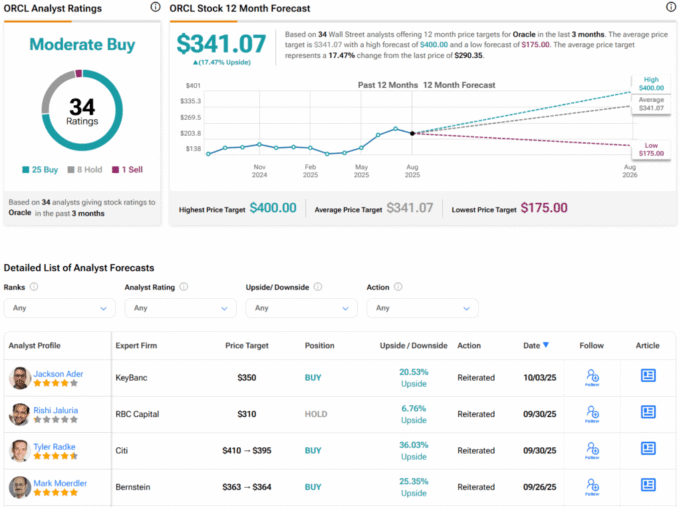

KeyBanc isn’t alone in seeing potential in Oracle. Wall Street, as a whole, has a “Moderate Buy” consensus rating on ORCL stock, based on 25 Buys, eight Holds, and one Sell assigned in the past three months, as indicated . The average ORCL price target of $341.07 per share implies 17.5% upside potential. KeyBanc maintains its “Buy” rating and a $350 price target, signaling strong confidence in Oracle’s long-term prospects.

But what does this mean for you, the investor? Here are a few things to consider:

- Diversification is Key: Don’t put all your eggs in one cloud basket. While Oracle shows promise, AWS and Azure are still dominant players. A diversified portfolio is always the wisest approach.

- Do Your Own Research: Don’t blindly follow analyst recommendations. Dig into Oracle’s financials, understand its cloud strategy, and assess the risks for yourself.

- Consider the Long Term: KeyBanc’s bullish outlook is based on long-term projections. Be prepared to hold the stock for several years to potentially reap the rewards.

The cloud landscape is constantly evolving, and the AI revolution is only accelerating the pace of change. Oracle‘s journey is not without risk, and there are potential challenges ahead. Increased competition, technological disruptions, and economic downturns could all impact its cloud growth. However, KeyBanc’s bullish prediction suggests that Oracle is well-positioned to capitalize on the opportunities presented by the AI era. Only time will tell if their vision comes to fruition, but for now, Oracle is a stock worth watching closely.