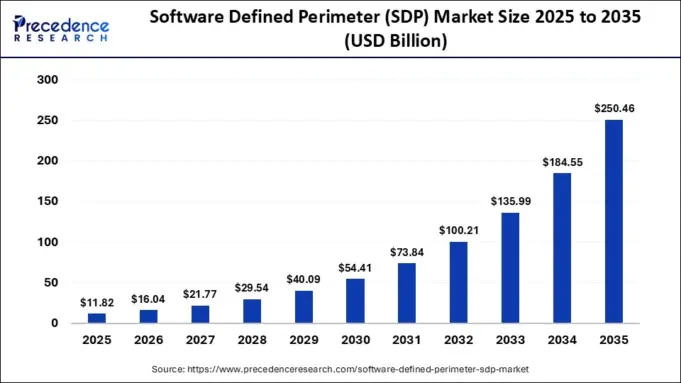

The report provides a detailed breakdown of the market drivers across several key segments, identifying specific trends in technology components, organization size, and end-user industries.

Component Analysis: IAM and Endpoint Security

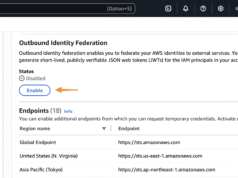

The Identity and Access Management (IAM) segment was the market leader in 2025. The report suggests its dominance is due to IAM’s critical role in enforcing identity-centric security within zero-trust frameworks. As companies grapple with remote workforces and bring-your-own-device (BYOD) policies, IAM-driven SDP solutions provide the granular authentication needed to secure applications. Meanwhile, the endpoint security segment is forecast to experience the highest CAGR during the 2026-2035 period. This growth is reportedly driven by the need to verify device health and compliance before granting network access, a crucial step in mitigating risks from compromised laptops, mobile devices, and IoT endpoints.

Organization Size: SMEs Lead, Large Enterprises Grow Fastest

In 2025, the small and medium-sized enterprises (SMEs) segment held the largest market share. The analysis attributes this to the increasing need for enterprise-grade security among smaller businesses that often lack the resources for complex, traditional security infrastructure. Government initiatives supporting the SME sector are also cited as a contributing factor. However, the large enterprises segment is expected to grow at the fastest CAGR. This is linked to the surging deployment of cloud-based cybersecurity solutions and collaborations with AI companies to develop advanced, AI-enabled security platforms to defend against sophisticated cyber threats.

End-User Industry: BFSI Dominates

The Banking, Financial Services, and Insurance (BFSI) segment dominated the market in 2025. The report states that financial institutions are prime targets for cyberattacks, making robust security a top priority. SDP’s zero-trust architecture helps these organizations secure sensitive data and meet stringent regulatory requirements like the General Data Protection Regulation (GDPR) and PCI DSS. The IT and telecom segment is also projected to grow significantly, fueled by investments in high-quality cybersecurity to protect against cybercrime and partnerships to design advanced security platforms.

The primary driver behind the projected market expansion is the global shift toward a zero-trust security architecture. This model, which assumes no user or device is trusted by default, is better suited to modern IT environments characterized by cloud computing, remote access, and diverse endpoints. The increasing frequency and sophistication of cyberattacks targeting these distributed environments have forced organizations to abandon legacy security perimeters. Furthermore, stringent data protection regulations worldwide mandate more robust and verifiable security controls, pushing organizations toward SDP solutions that offer granular access control and continuous verification.

While the report outlines market size and growth trends, specific details remain unaddressed. The analysis does not include a comparative breakdown of pricing models for different SDP solutions, nor does it provide real-world performance benchmarks or deployment timelines for enterprises of varying sizes. The specific market share of leading vendors and their strategic roadmaps beyond high-level partnerships are also not detailed in the provided summary.

The market is expected to see continued and rapid evolution, with a particular focus on the integration of AI into security platforms for more advanced threat detection and response. The high projected growth in the large enterprise and endpoint security segments suggests a future where SDP solutions become more deeply embedded with device management and compliance tools. Industry watchers can also anticipate further product launches and partnerships, similar to the reported launch of Duo Identity and Access Management by Cisco, aimed at addressing specific threats like phishing within an IAM context.

For IT and security professionals, the report’s findings suggest several areas of focus. Organizations can evaluate their current security posture to identify gaps in their zero-trust implementation. It is also pertinent to assess various SDP vendor offerings to understand how they align with specific organizational needs, such as remote access, cloud application security, and endpoint compliance. Finally, security teams should prepare for deeper integration of endpoint security measures as a prerequisite for network access, ensuring that device health and posture checks are part of their access control policies.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates