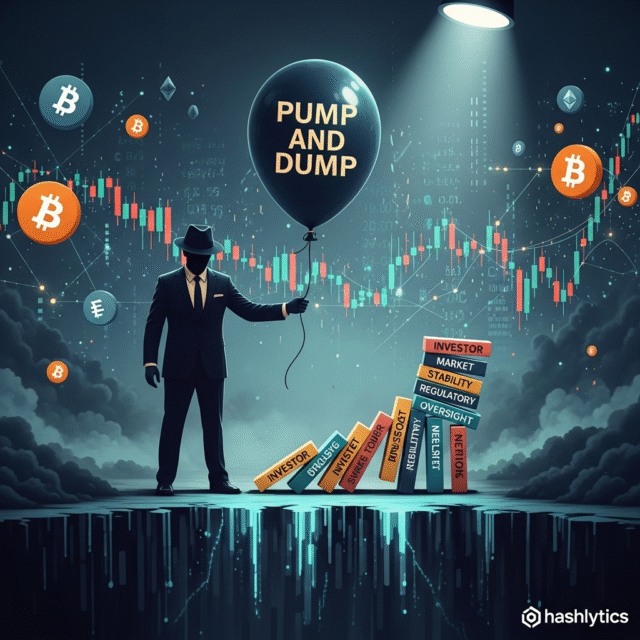

How Scammers Execute the Scheme

The process begins on cryptocurrency launch platforms like Pump.fun and similar launchpads where new tokens are introduced daily. Scammers monitor these platforms closely, identifying cryptocurrencies that quickly gain traction and reach market caps of one to two million dollars within an hour of launch.

Once they identify a trending token, they replicate it. Using the exact same name, logo, and branding, scammers launch a duplicate cryptocurrency on the same or different platforms. This creates confusion in the market, as investors mistake the fraudulent token for the legitimate one that’s gaining momentum.

The Trap for Investors

Unsuspecting investors, eager to capitalize on what appears to be a rapidly growing opportunity, purchase the copycat token. The scammers benefit from the confusion and FOMO (fear of missing out) that drives crypto markets. Within 10 to 20 minutes of attracting enough buyers, the perpetrators dump their holdings, crashing the token’s value and disappearing with the profits.

Why This Scheme Persists

The decentralized and largely unregulated nature of cryptocurrency markets makes these schemes relatively easy to execute and difficult to prosecute. The speed at which tokens can be created and launched, combined with the anonymous nature of blockchain transactions, provides scammers with the perfect environment for exploitation.

Protecting Yourself

Investors should verify token contracts, research project legitimacy through official channels, and avoid making impulsive decisions based on rapid price movements. Remember: if an investment opportunity seems too easy or too good to be true, it probably is. The cryptocurrency space requires due diligence, patience, and a healthy dose of skepticism to navigate safely.