-0.08%

+0.49%

-2.94%

-4.50%

-3.45%

+1.54%

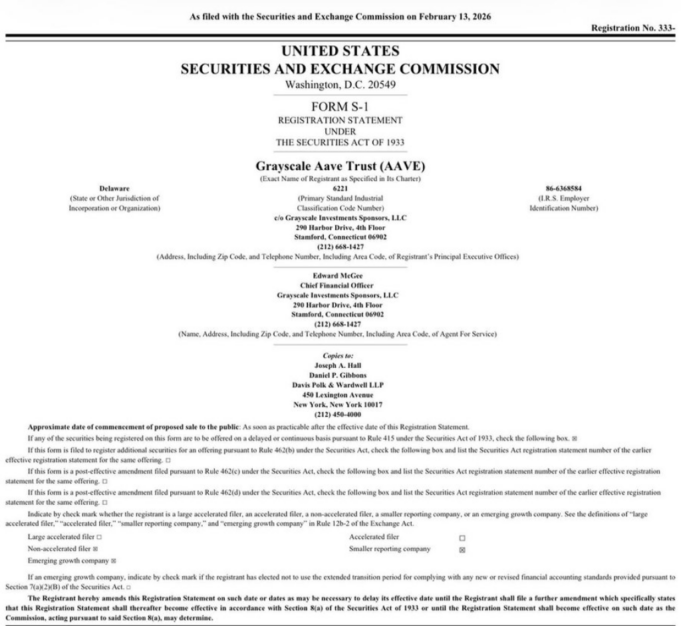

Grayscale Investments filed an S-1 registration statement with the U.S. SEC on February 6, 2026, seeking approval for the Grayscale Aave Trust, a publicly traded investment vehicle tracking the AAVE token. The filing represents the first formal attempt to create an exchange-traded product for a DeFi protocol, potentially opening institutional and retail access to Aave through traditional brokerage accounts.

Filing Details and Structure

The S-1 registration statement under the Securities Act of 1933 outlines a trust structure similar to Grayscale’s existing cryptocurrency products. The proposed Grayscale Aave Trust would hold AAVE tokens as its underlying asset, with shares trading on a national securities exchange if approved. Grayscale Investments, LLC serves as sponsor, leveraging its experience from managing over $20 billion in digital asset products including Bitcoin and Ethereum trusts.

The filing marks a strategic shift for Aave from purely on-chain metrics to regulatory compliance considerations. Unlike previous cryptocurrency ETF attempts focused on store-of-value assets, this product requires SEC review of a lending and borrowing protocol with governance mechanisms and smart contract risks.

Regulatory Path and Precedent

The approval process will likely differ significantly from the Bitcoin ETF approvals granted in January 2024. While Bitcoin ETFs addressed market surveillance and custody concerns for a relatively straightforward asset, an Aave product introduces operational complexity around decentralized lending protocols. The SEC must evaluate how the protocol functions, smart contract security, governance token mechanics, and the implications of holding a token that provides voting rights in a decentralized system.

Ethereum ETFs, which received approval in stages throughout 2024-2025, faced scrutiny over proof-of-stake mechanisms and staking yields. The Aave protocol‘s additional layers of lending markets, liquidation mechanisms, and protocol governance present new regulatory considerations that extend beyond previous crypto ETF frameworks.

DeFi-Specific Challenges

Regulators will examine risks unique to DeFi protocols that didn’t apply to Bitcoin or Ethereum ETFs. Smart contract vulnerabilities, protocol governance changes through token voting, liquidity dynamics in lending pools, and the decentralized nature of protocol upgrades all represent areas requiring regulatory comfort. The SEC’s framework for evaluating these factors remains undeveloped, as no DeFi protocol has previously sought this level of regulated market access.

Aave’s governance structure, where AAVE token holders vote on protocol parameters including interest rate models and collateral factors, introduces questions about how a regulated investment vehicle participates in or abstains from governance decisions. The trust structure must address whether and how it exercises voting rights on behalf of shareholders.

Market Context and Timing

The filing gained attention after crypto analyst Crypto Patel highlighted it on social media, framing the development as a potential milestone for DeFi’s institutional adoption. Market observers note that Grayscale’s move signals preparation for what could be a lengthy regulatory review with uncertain outcome.

The timing follows Grayscale’s successful conversion of its Bitcoin Trust to a spot Bitcoin ETF in January 2024 after a legal battle with the SEC. That precedent established Grayscale’s litigation strategy for challenging regulatory delays, though the firm hopes to avoid similar conflicts with the Aave filing by addressing DeFi-specific concerns proactively in its registration materials.

Industry Implications

Approval would establish a framework for other DeFi protocols seeking regulated investment products. Compound, Uniswap, and MakerDAO represent protocols that could follow Aave’s path if the SEC develops clear standards for DeFi ETF approval. Conversely, rejection or indefinite delays would signal regulatory skepticism toward bringing complex DeFi mechanisms into traditional financial markets.

Traditional finance institutions have monitored DeFi protocols but largely avoided direct exposure due to regulatory uncertainty and operational complexity. A regulated Aave product would provide accessibility without requiring institutions to interact with cryptocurrency exchanges, wallet custody, or smart contracts directly.

Timeline and Next Steps

The SEC review process for cryptocurrency ETFs has historically taken 6-24 months, with the agency often requesting multiple amendments addressing concerns about market manipulation, custody arrangements, and investor protection. Grayscale has not provided an expected approval timeline, acknowledging that DeFi’s novelty within the regulatory framework introduces unpredictability.

The filing itself does not trigger immediate market action or create tradeable shares. The trust cannot operate until SEC approval, and no assurance exists that approval will be granted. The filing represents the beginning of a regulatory dialogue rather than an imminent product launch.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates