+3.26%

+5.96%

-0.64%

-4.79%

-3.67%

+4.68%

The DeFi landscape is witnessing a remarkable shift as newcomer Aster DEX demonstrates the explosive potential of innovative trading features in decentralized finance. In a space where trading volumes typically dictate success, Aster’s meteoric rise proves that sometimes, it’s the unique value proposition that matters most.

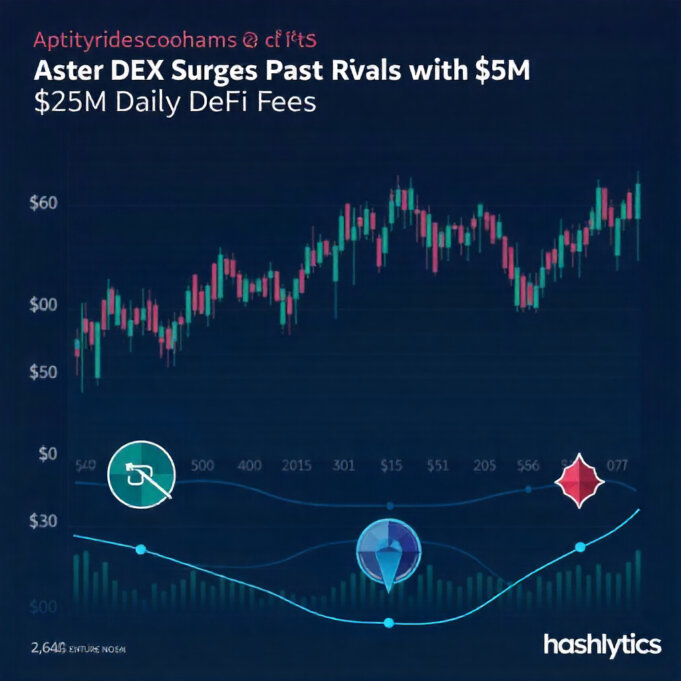

Aster DEX Surges Past Rivals with $25M Daily DeFi Fees

In a stunning development that has caught the attention of crypto veterans and newcomers alike, Aster has rocketed to the summit of DefiLlama’s protocol fee rankings, generating an impressive $25 million in daily fees. This achievement is particularly noteworthy when compared to established competitor Hyperliquid’s $3.17 million – a difference that speaks volumes about Aster’s rapid market penetration.

What makes this surge even more fascinating is that it defies conventional DeFi wisdom. Despite ranking 13th in trading volume with $199.96 million compared to Hyperliquid’s $477.3 million, Aster has managed to generate significantly higher fees. This suggests a fundamental shift in how value is created in decentralized exchanges.

Innovation Meets Market Demand: The Aster Advantage

At the heart of Aster’s success lies its revolutionary “hidden orders” feature – a game-changing innovation that has struck a chord with sophisticated traders. This functionality allows users to place completely invisible limit orders, offering a level of trading privacy previously unavailable in the transparent world of on-chain trading.

The platform’s evolution from its roots as APX Finance to its current incarnation following the Astherus merger has been nothing short of remarkable. Industry experts suggest that this transformation, coupled with strategic backing and multi-chain support, has created a perfect storm for success.

When Changpeng Zhao, Binance’s co-founder, tweeted “Few understand this. Aster competes with Binance, but helps BNB,” it wasn’t just an endorsement – it was a recognition of how Aster is redefining the DeFi competitive landscape. The platform’s ability to simultaneously compete with and complement existing infrastructure demonstrates a sophisticated understanding of ecosystem dynamics.

Growth Trajectory and Market Impact

Since its September token launch, Aster’s growth metrics have been staggering. The platform’s native token ASTER has helped drive its fully diluted valuation to $15.1 billion – a remarkable increase from its initial $560 million valuation. This growth trajectory suggests strong market confidence in Aster’s long-term potential.

The platform’s recent handling of the XPL perpetual contract incident, where it reimbursed users in USDT after a sudden price spike, demonstrates a commitment to user protection that’s essential for long-term success in DeFi.

Looking ahead, Aster’s success could signal a broader shift in DeFi trading preferences. The platform’s ability to generate substantial fees despite lower trading volumes suggests that users are willing to pay a premium for innovative features and enhanced trading capabilities. This could inspire a new wave of DeFi innovations focused on user experience rather than just liquidity metrics.

For traders and investors watching the space, Aster’s rise represents more than just another success story – it’s a testament to how innovation and user-centric features can rapidly reshape market dynamics in the fast-moving world of decentralized finance.