-1.70%

+1.67%

+1.34%

-0.08%

+1.36%

+1.90%

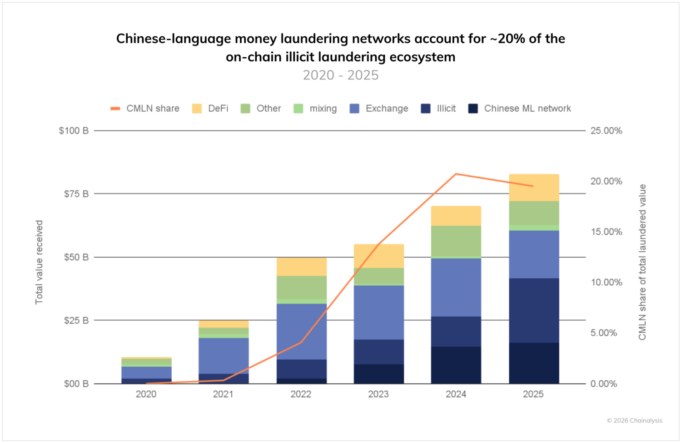

Chinese-language money laundering networks (CMLNs) processed an estimated $16.1 billion in illicit funds in 2025, according to a new crypto crime report from blockchain analytics firm Chainalysis. The activity, which amounts to nearly $44 million per day, highlights a dramatic shift in the crypto laundering landscape, with these networks now handling approximately 20% of all known illicit crypto flows over the past five years.

The report, released in early 2026, details the rapid expansion of CMLNs since 2020. According to the analysis, the growth of illicit inflows to these networks has been 7,325 times faster than the growth of illicit funds sent to centralized exchanges over the same period. Researchers identified more than 1,799 active wallets associated with these operations in 2025. The networks are reportedly a primary destination for funds stolen in pig butchering scams, with CMLNs consistently laundering over 10% of funds from this type of fraud.

Chainalysis identified six distinct types of services within the CMLN ecosystem. Some, like “Black U” services, specialize in fragmenting large transactions into smaller amounts to evade detection—a practice known as smurfing. Conversely, over-the-counter (OTC) services focus on consolidating many small transactions into large sums for re-entry into the legitimate financial system. The fastest-growing services, “Black U,” were able to process their first $1 billion in just 236 days.

Experts note that this trend represents a significant evolution from traditional underground banking. According to the Centre for Finance & Security (CFS) at RUSI, the biggest change in Chinese money laundering networks in recent years is a rapid transition to crypto from reliance on informal value transfer systems.

The organization explained that cryptocurrency offers an efficient method for moving funds across borders discreetly, reducing reliance on complex manual ledgers. Launderers reportedly view crypto as having less stringent Know Your Customer (KYC) compliance than traditional banks, which increases the speed of their operations.

The operational structure of CMLNs leverages platforms and specialized roles to function. “Guarantee platforms” such as Huione and Xinbi act as escrow and marketing venues for laundering vendors, though Chainalysis did not include their transaction volumes in its $16.1 billion total. The layering phase is often handled by “money mules,” or “motorcades,” who use a network of accounts to obscure the origin of funds through a complex series of transactions. These operators openly advertise on platforms like Telegram, primarily in Mandarin, detailing accepted payment methods like AliPay and WeChat.

While the report quantifies the total value processed, the exact breakdown of funds originating from specific criminal activities beyond pig butchering scams is not fully detailed. The individual identities of the operators behind the thousands of active wallets remain largely anonymous. Furthermore, the total transaction volume facilitated by ancillary “guarantee platforms” is not specified.

Regulators are taking notice of the growing threat. The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) has previously identified related entities, such as the Prince Group, as a primary money laundering concern. The report suggests that while enforcement actions can disrupt specific platforms, operators often migrate to new channels. This highlights a need for strategies that target the individual laundering operators directly rather than just the services they use.

To avoid interaction with illicit financial networks, individuals and businesses operating in the crypto space should consider several precautions. Engage exclusively with regulated exchanges that enforce strong Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. Be cautious of unsolicited investment offers, especially those originating from social media and messaging apps. Utilize on-chain analysis tools to screen wallet addresses before engaging in transactions with unknown entities. Finally, report any suspicious activity to the relevant exchange compliance departments and law enforcement agencies.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates