-1.70%

+1.67%

-3.43%

-2.33%

+0.37%

-0.64%

Ethereum‘s recent price action has been volatile, influenced by significant ETF outflows and selling pressure from long-term holders, leading to a price decline. However, substantial whale activity and anticipation surrounding the upcoming Fusaka upgrade offer potential support, creating a dynamic situation for the smart contract platform.

The immediate challenge for Ethereum is navigating this turbulent period, highlighted by a 6.6% dip in the past week. The critical question is whether this is a temporary setback or an indication of deeper, more fundamental issues.

Recent data reveals a challenging scenario for Ethereum. Spot Ethereum ETFs have experienced over $1.4 billion in net outflows, signaling reduced institutional investor interest. This outflow coincides with increased selling from long-term holders – those who have held their ETH for three to ten years – further contributing to downward price pressure.

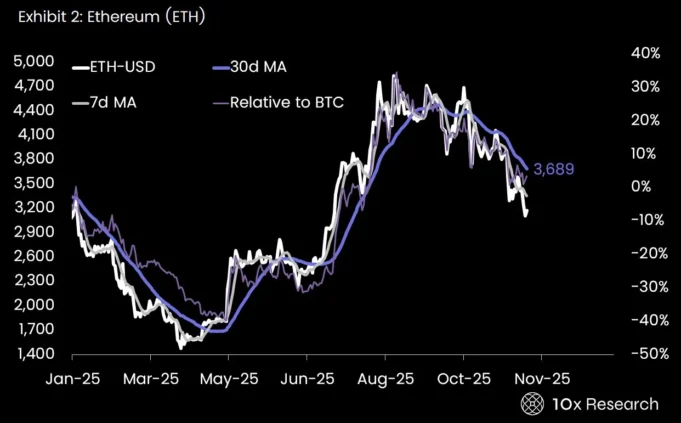

According to 10x Research, this group is selling off their ETH at levels not seen since 2021, a period marked by high market volatility. The motivation behind this selling pressure remains a key question: Are these holders cashing out after significant gains, or do they anticipate further price declines?

Adding to the complexity, Ethereum is currently trading below both its 7-day and 30-day moving averages, reinforcing the bearish sentiment. The recent reversal from highs has left ETH struggling against both the dollar and Bitcoin, creating a challenging environment for bullish investors.

Despite the overall negative sentiment, there’s a sign of potential support: significant accumulation by large “whale” addresses. 10x Research reports that these large holders have acquired hundreds of thousands of ETH, totaling over $1 billion, during the recent price dip.

This whale activity provides a substantial counterweight to the selling pressure. However, it’s important to remember that sustained recovery requires more than just whale buying. Until Ethereum reclaims its short- and medium-term moving averages, the overall outlook remains somewhat bearish.

Ethereum’s price is currently fluctuating around critical weekly liquidity areas. Chart analysis from CapoLittle indicates that the current market structure shows a series of strong highs and lows, liquidity sweeps, and trendline reactions that have historically influenced ETH’s movements.

These “sweeps” often coincide with trendline touches, suggesting that leveraged positions are being liquidated before price reversals. Currently, ETH is moving back towards a convergence of support formed by a key trendline.

The chart also highlights a recent break of structure near the upper resistance band, a move that previously led to a sharp upward surge. If ETH can maintain its position above the highlighted liquidity zone, there is potential for a rebound towards the upper boundary. Conversely, a decisive break below the trendline liquidity region would likely shift focus to deeper support levels from previous cycles.

Looking beyond the immediate price fluctuations, Ethereum is preparing for the Fusaka upgrade. This is a significant development that could potentially reshape the network’s future and improve performance.

As pointed out by analysts, the Pectra upgrade in May 2025, preceded a 53 percent rally. Analysts are closely monitoring how the upcoming upgrade might influence Ethereum’s price trend. This is a crucial period, with network changes and investor expectations poised to converge.

Ethereum is at a critical point. While immediate challenges exist, including ETF outflows and technical breakdowns, whale accumulation and the potential of the Fusaka upgrade offer some hope. The next few weeks will be crucial in determining Ethereum’s trajectory for the remainder of the year. The market is closely watching to see if Ethereum can overcome these challenges and emerge stronger.