-1.70%

+1.67%

-1.88%

+3.11%

-6.75%

-7.85%

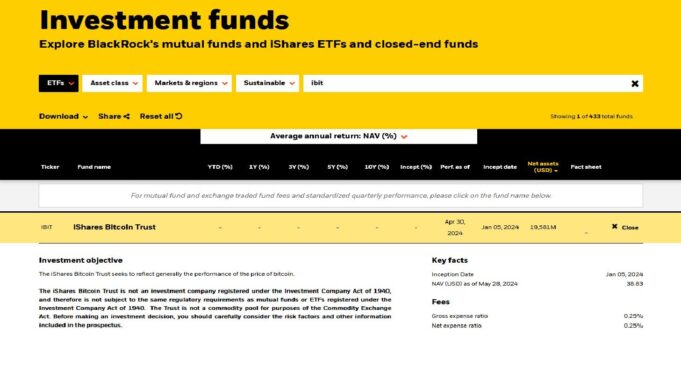

The old guard is officially on board. Harvard University, an institution synonymous with tradition and fiscal prudence, has made a bold move into the digital age, catapulting BlackRock’s Bitcoin ETF (IBIT) to the top of its portfolio. This isn’t just another investment; it’s a signal flare to other institutional investors still perched on the sidelines, wondering if the crypto water is finally safe to enter.

As of the end of the third quarter, Harvard’s treasury disclosed holding a staggering 6.81 million shares of IBIT, a position valued at $442.88 million. The SEC filing revealing this allocation sent ripples through both the academic and financial worlds, prompting speculation about what this means for the future of digital asset adoption.

The speed and scale of Harvard’s pivot are particularly noteworthy. Just three months prior, at the end of June, their IBIT holdings clocked in at a comparatively modest $116 million. This represents a 280% increase in a single quarter, a growth rate that makes even the most seasoned portfolio managers raise an eyebrow.

This aggressive accumulation has reshaped Harvard’s investment landscape. Bitcoin now commands approximately 20% of their total portfolio, eclipsing longstanding positions in tech giants like Microsoft ($322.8 million) and Amazon ($235.18 million), as well as traditional safe havens like the SPDR Gold Trust ($235.1 million).

The question on everyone’s mind: what’s driving this sudden institutional embrace of Bitcoin ETFs? Several factors are likely at play:

- Maturity of the Market: Bitcoin ETFs provide a regulated and accessible on-ramp for institutions previously deterred by the complexities of direct crypto ownership.

- BlackRock’s Credibility: As the world’s largest asset manager, BlackRock’s foray into Bitcoin lending legitimacy and instilling confidence.

- Performance: Bitcoin’s recent price surge has undoubtedly caught the attention of investment committees seeking alpha.

Bloomberg analyst Eric Balchunas succinctly captured the significance of Harvard’s move. “It’s extremely rare and difficult to get an endowment to join an ETF, especially Harvard or Yale,” Balchunas noted. “It’s the best endorsement an exchange-traded product can get.”

“It’s extremely rare and difficult to get an endowment to join an ETF, especially Harvard or Yale. It’s the best endorsement an exchange-traded product can get.” – Eric Balchunas, Bloomberg Analyst

While Harvard’s IBIT position represents a relatively small fraction (1%) of BlackRock’s target fund level of $50 billion, its symbolic weight is undeniable. It positions Harvard as the 16th largest holder of IBIT, setting a precedent for other institutions to follow.

Harvard isn’t alone in recognizing the potential of Bitcoin ETFs. Other academic institutions are also dipping their toes into the crypto waters.

Emory University, for example, increased its holdings in Grayscale’s Bitcoin Mini Trust ETF by 90% during the same quarter, reaching a value exceeding $42.9 million. This suggests a broader trend of institutional investors exploring diversified exposure to Bitcoin through various ETF vehicles.

Even beyond US institutions, the allure of Bitcoin is spreading. A Spanish technology institute is reportedly in discussions to sell 97 BTC acquired over a decade ago, showcasing a growing willingness to engage with the digital asset market.

Harvard’s bold move into Bitcoin ETFs may prove to be a watershed moment. As more institutions allocate capital to digital assets, the market is poised for increased stability, liquidity, and ultimately, mainstream acceptance. While volatility remains a factor, the long-term potential of Bitcoin as a store of value and a hedge against inflation continues to attract sophisticated investors seeking to diversify their portfolios and stay ahead of the curve. The question now is not if, but when, the rest of the institutional world will follow suit.