-1.70%

+1.67%

+1.02%

+1.05%

+0.19%

-1.70%

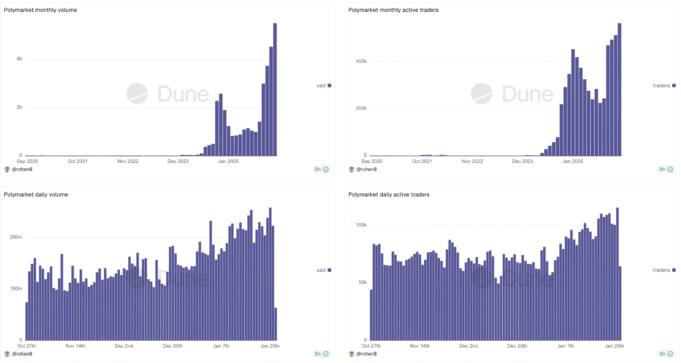

- Previous Peak Volume: Over $1 billion in betting volume during the 2024 election cycle, according to company statements.

- Regulatory History: Received a $1.4 million fine from the Commodity Futures Trading Commission (CFTC) in for unregistered event contracts.

- US Relaunch: Reinstated operations in the US in after restructuring to align with federal derivatives rules.

- Key Partnerships: Major League Soccer (MLS), Ultimate Fighting Championship (UFC), National Hockey League (NHL), and DAZN.

By framing its offerings as event contracts under the purview of the Commodity Futures Trading Commission (CFTC), Polymarket is strategically positioning itself as a federally regulated entity, distinct from state-by-state licensed gambling operators. This partnership with MLS is a direct play for a mainstream audience that understands sports outcomes but is unfamiliar with crypto speculation. The goal isn’t just to attract existing sports bettors, but to normalize the use of crypto rails for real-world event forecasting. Following its high-profile success with political markets, Polymarket is now aggressively diversifying into sports, which offers a higher frequency of events and a broader, more engaged user base. This expansion signals a strategic shift from niche, high-stakes events to everyday consumer engagement.

Despite its recent successes, Polymarket’s entire model rests on a fragile regulatory interpretation. The line between a derivatives contract and a gambling instrument can be thin, and a future CFTC administration could easily revisit its stance, as seen in the 2022 enforcement action that temporarily forced them from the US market. Furthermore, Polymarket faces immense competition from entrenched, well-capitalized sports betting giants like DraftKings and FanDuel. These platforms have massive marketing budgets and deep user loyalty. Convincing the average sports fan to navigate a crypto-based platform, even a simplified one, remains a significant hurdle to mass adoption. The user experience must be flawless to overcome the inertia of traditional platforms.

The most critical near-term catalyst is the promised launch of a native POLY token and a subsequent airdrop. According to Polymarket’s CMO, this has been planned since its US relaunch and would create powerful incentives for user acquisition and platform loyalty. We should also monitor the user engagement metrics from these new MLS markets; actual adoption will be the ultimate test of this mainstream strategy. Finally, keep an eye on Polymarket’s next partnership target. Securing a deal with an even larger league, like the NFL or NBA, would represent a monumental step in its quest for market dominance and further legitimize the event contract model in the United States.

- Polymarket is leveraging federal commodities regulation to bypass state-level gambling laws, enabling a nationwide footprint.

- The MLS partnership is a key part of a broader strategy to attract non-crypto native users by focusing on familiar, real-world events.

- Regulatory risk remains the primary threat, as the distinction between prediction markets and gambling is subject to interpretation by the CFTC.

- The upcoming POLY token airdrop will be a pivotal event for incentivizing platform growth and liquidity.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates