-1.01%

-3.09%

-3.54%

-1.17%

+0.66%

+0.87%

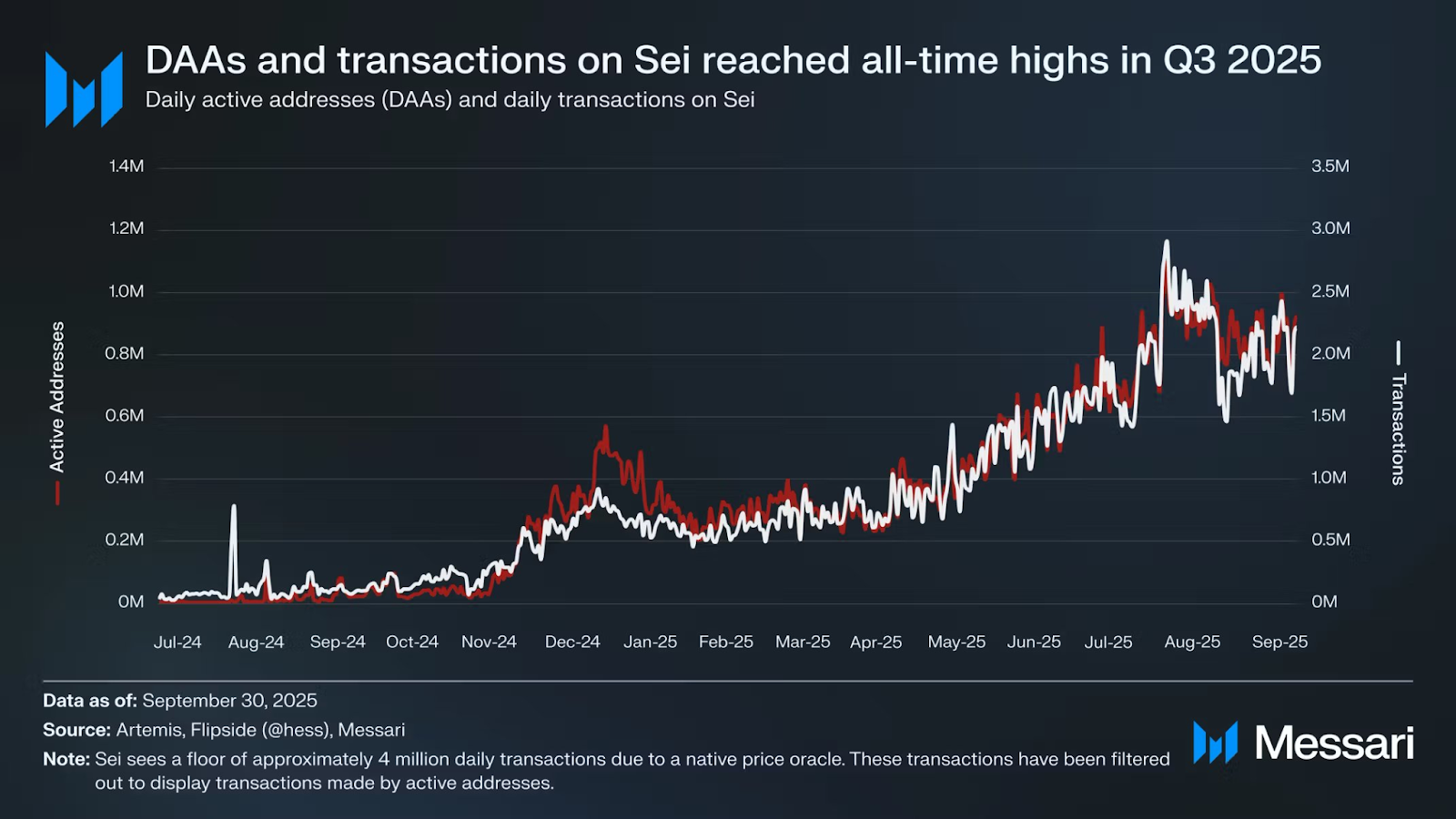

Sei Network recorded its fifth straight quarter of network growth in . Average daily active addresses rose 93.5% quarter over quarter, reaching 824,000, while daily transactions climbed 87.1% to approximately 2 million, as reported by Messari. Gaming emerged as a significant driver of usage, generating 116 million transactions and attracting over 800,000 daily active users.

Despite a 25.3% drop in total value locked (TVL) to $455.6 million, mainly attributed to stablecoin outflows and SEI price declines, decentralized exchange (DEX) trading volume on Sei increased by 75% quarter-over-quarter to $43 million. DragonSwap reclaimed its position as the leading DEX with $13.2 million in daily volume, and Takara Lend saw its TVL grow by 48.4% to $105.8 million.

Token-side dynamics for SEI holders reportedly improved during the quarter. The monthly vesting rate decreased sharply in as the Sei Foundation’s allocation fully vested and ecosystem reserve emissions slowed. Annualized inflation fell from 4.8% to 4.4%, and staking yields rose to 6.0%, leading to a positive real yield for stakers for the second consecutive quarter. The circulating supply increased to 6.13 billion SEI due to scheduled unlocks. Analyst Michael van de Poppe suggested that a Bitcoin (BTC) price exceeding $90,000 could further support SEI’s rally.

also saw several partnerships for Sei Network, including wallet support from MetaMask and Backpack, analytics via SeiScan, and low-latency data feeds from Chainlink. The report also indicated that several institutions have announced plans to deploy products on Sei.

The growth on Sei Network is attributed to its low-latency design and its capacity to manage burst demand at scale, with the network claiming a capacity exceeding 200,000 transactions per second at a low cost. Additionally, improved token-side dynamics, including a reduced monthly vesting rate and increased staking yields, contributed to positive sentiment among SEI token holders.

Specific details regarding the institutional products planned for deployment on Sei Network and their expected launch timelines were not disclosed in the report. The exact impact of Bitcoin‘s price on SEI’s potential rally remains a projection by an analyst rather than a confirmed market outcome.

Users can anticipate continued developments in the Sei Network ecosystem, particularly with the announced institutional deployments. The ongoing partnerships with platforms like MetaMask and Chainlink suggest potential enhancements in user accessibility and data services. The reported positive real yield for stakers could encourage further participation in the network’s staking mechanisms.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates