+1.99%

+3.00%

-0.40%

+0.20%

+3.24%

+0.01%

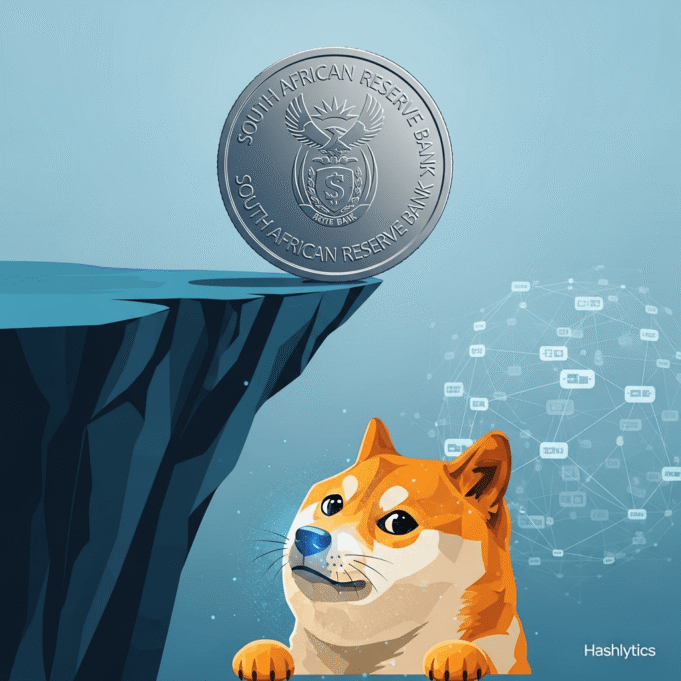

The digital finance realm is currently a complex mix of potential and peril, underscored by the South African Reserve Bank’s (SARB) warnings regarding digital assets and Bitwise’s ambition to launch a Dogecoin (DOGE) ETF. This rapidly evolving environment, characterized by increasing regulatory attention and innovative applications of Artificial Intelligence (AI), demands careful consideration of the trajectory of digital assets. The future of finance is unfolding at a rapid pace, requiring informed decision-making in a dynamic and often unpredictable market.

The South African Reserve Bank (SARB) has voiced significant concerns about the risks inherent in digital assets. The central bank is particularly concerned about the potential for illicit financial activities and the inherent volatility associated with the cryptocurrency market. This cautious stance suggests a likely increase in regulatory oversight within South Africa’s digital asset space.

The long-term effects of this regulatory approach remain to be seen, specifically whether it will stifle innovation or provide much-needed stability. The SARB’s active monitoring of the situation demonstrates its commitment to protecting the integrity of the financial system.

Despite the growing regulatory scrutiny, technology companies continue to invest heavily in Artificial Intelligence (AI) and blockchain technologies. These investments are primarily focused on enhancing consumer engagement through personalized and secure user experiences, such as AI-powered financial advisors and blockchain-verified transactions.

The primary challenge lies in the effective implementation of these advanced technologies to unlock their full potential, rather than simply treating them as experimental novelties. The successful integration of AI and blockchain has the potential to revolutionize various aspects of the financial industry, from streamlining transactions to improving security.

In Spain, authorities are actively seeking to increase tax revenue derived from crypto investors, aligning the taxation of digital asset gains with traditional investment taxation models. This move reflects a global trend among governments to more closely scrutinize and regulate crypto income, which could lead to increased reporting requirements and tax burdens for investors.

The fairness of these tax measures is a subject of ongoing debate, with some critics arguing that they are excessively punitive and could discourage the adoption of cryptocurrencies. Nevertheless, governments around the world are increasingly focused on capturing a portion of the revenue generated by the growing digital asset market.

A recent incident involving the theft of $11 million in digital assets from Sam Altman’s ex-boyfriend serves as a stark reminder of the security vulnerabilities inherent in the crypto space. While the details of the incident remain unclear, it underscores the critical need for robust security protocols and the secure management of private keys to prevent unauthorized access and theft.

This incident highlights a fundamental principle of the decentralized crypto world: individuals bear the primary responsibility for both their financial assets and the security measures protecting them. Vigilance and proactive security measures are essential for mitigating the risks associated with digital asset ownership.

Bitwise has recently garnered attention by seeking regulatory approval for a Dogecoin (DOGE) ETF, an exchange-traded fund based on the popular meme coin. This ambitious proposal has sparked considerable debate within the financial community, with some viewing it as an innovative investment opportunity, while others perceive it as a reflection of excessive market exuberance and speculative behavior.

Regardless of the ultimate outcome, the very proposal of a DOGE ETF highlights the evolving perception and increasing acceptance of cryptocurrencies within the broader financial landscape. It challenges conventional investment norms and underscores the growing influence of meme-driven assets in the modern financial system.

A US bank is actively exploring the potential applications of stablecoins by testing one on the Stellar platform. This initiative aims to streamline transaction processes and significantly reduce operational costs, potentially transforming traditional banking operations. It represents a cautious but significant step towards integrating digital assets into mainstream financial institutions.

While the complete integration of traditional finance and the crypto world may still be some time away, this development suggests a growing interest and willingness to explore the potential benefits of blockchain technology within established financial institutions, paving the way for greater efficiency and innovation.

Polymarket, a prediction market platform, has been authorized to re-enter the US market, signaling a potentially positive shift in regulatory attitudes towards decentralized forecasting platforms. This development represents a victory for advocates of blockchain-based prediction markets and suggests a growing openness to innovative applications of the technology within the United States.

Polymarket’s return could potentially reshape how predictions and forecasts are made, leveraging the power of decentralized networks and blockchain technology to offer new insights and perspectives on a wide range of topics.

Analyzing Bitcoin’s current market behavior reveals a period of price consolidation, indicating the potential for both upward and downward price movements in the near future. Traders are closely monitoring key support and resistance levels, anticipating the next significant market swing.

It is crucial to remember that past market performance is not a reliable predictor of future results. Responsible trading practices and careful risk management are essential for navigating the volatile cryptocurrency market and mitigating potential losses.

The digital finance landscape is characterized by constant change, presenting both significant opportunities and inherent risks. Staying informed, remaining vigilant, and questioning established norms are essential for successfully navigating this evolving environment. The future of finance is being actively shaped now, and proactive participation is key to influencing its direction and ensuring a positive outcome.