+1.99%

+3.00%

+0.06%

+0.60%

+0.21%

-0.02%

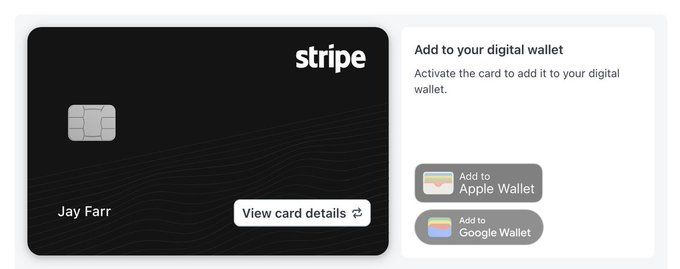

Stripe unveiled physical debit cards that let businesses spend directly from their Stripe balance, marking the company’s entry into a space dominated by Wise since 2015. The sleek black cards, shown in leaked images with Apple Wallet and Google Wallet integration, position Stripe as a comprehensive financial platform, not just a payment processor.

Stripe’s product lead teased the launch on X: “One of the most exciting things we’re working on @stripe.” While Stripe Issuing has offered white-label cards for businesses to issue to their customers since 2020, this marks the first time Stripe itself issues cards directly to merchants for spending company funds.

What Makes This Different

| Feature | Stripe Issuing (Existing) | Stripe Cards (New) |

|---|---|---|

| Who Issues | Businesses issue to their end users | Stripe issues to merchants |

| Use Case | Employee expenses, customer rewards | Business spending from Stripe balance |

| Customization | Fully branded, custom designs | Standard Stripe design |

| Cost | $3.50 per card + 0.2% + $0.20 per transaction | TBD (likely free for active merchants) |

| Target | Platforms building card programs | Direct Stripe merchants |

User reactions immediately referenced Wise’s business debit card, which lets companies hold balances in 40+ currencies and spend with minimal FX fees. One X commenter noted: “Wise are dominating this space but competition is always good!”

How They Stack Up

| Feature | Wise Business Card | Stripe Card (Expected) |

|---|---|---|

| Card Fee | $9 one-time | TBD (likely free) |

| Multi-Currency | 40+ currencies, real mid-market rate | USD-settled (currency conversion TBD) |

| FX Fee | 0.35-2% depending on currency pair | Likely 1% (matching Stripe payout fees) |

| ATM Withdrawals | Free up to $100/month, then 2% | Unknown |

| International Availability | 61 countries | 46 countries (Stripe’s current reach) |

| Customer Support | Highly rated (24/7 chat, email, phone) | Mixed reviews (chat/email, wait times vary) |

A critical X exchange exposed Stripe’s Achilles heel. A user wrote: “Wise support has always been second to none. I really can’t say the same for Stripe, quite the opposite, even. And their 1% extra charge on foreign currency because I’m located outside of the US, even if we have a US bank account, and only charge in USD, it’s pure robbery. No chance I’m moving.”

Stripe’s response: “Heard. Anything specific with support that’s been frustrating that we can improve? Is it wait times? Quality? For the extra charges? Are you referring to payouts or XB fees?”

The exchange highlights two issues Stripe must address to compete with Wise:

- Support quality: Wise consistently ranks higher in customer satisfaction (4.4/5 on Trustpilot vs Stripe’s 1.8/5)

- Hidden FX fees: Stripe charges 1% currency conversion + 1% cross-border fees even when merchants have USD accounts and only process USD—totaling 2% on international transactions

Who Mentioned This “Would Be Amazing”

Developer and entrepreneur Pieter Levels (founder of Nomad List and RemoteOK) posted about wanting exactly this product last year. His tweet sparked discussions among digital nomads and global entrepreneurs frustrated by Wise’s transfer speed limitations and Stripe’s lack of spending card options.

The Use Case for Digital Entrepreneurs

- Revenue accumulates in Stripe from global SaaS customers

- Currently requires transferring to bank, then to Wise for international spending

- Stripe card would eliminate the middle step, saving 1-3 days and transfer fees

International Availability Will Determine Success

As one user emphasized: “International availability is what will make this work.” Stripe currently operates in 46 countries, while Wise supports sending money from 61 countries and receiving in 200+ destinations. For Stripe’s card to compete, it needs:

- Global issuance: Cards available to merchants in at least 30+ countries at launch

- Competitive FX: Rates matching or beating Wise’s transparent mid-market + 0.35-2% model

- Local currency spending: No extra fees when using the card in countries outside merchant’s home region

Stripe hasn’t disclosed card fees, but expect one of two models:

Model 1: Free Card, Revenue from FX

- No card fee for merchants processing $10K+ monthly

- 1% FX markup on foreign currency spending (matching current payout fees)

- This undercuts Wise’s $9 card fee but matches their 0.35-2% FX rates

Model 2: Interchange Revenue Share

- Free card for all merchants

- Stripe keeps interchange fees (1-3% paid by merchants where card is used)

- Merchant sees no direct cost but indirectly pays through interchange

What Stripe Needs to Get Right

1. Transparent Fee Structure

Users called out Stripe’s “pure robbery” 1% international fee even for USD-only transactions. The card product must clearly explain all charges upfront, no hidden cross-border fees, no ambiguous “XB fees” that confused the user in the X thread.

2. Support That Matches Wise

Wise’s 24/7 multilingual support with average 2-minute chat response times sets the bar. Stripe’s current support model — email/chat during business hours with variable quality — won’t cut it for a financial product people rely on daily.

3. Multi-Currency Balances

Wise lets users hold 40+ currencies and spend without conversion. If Stripe only offers USD-settled cards with 1% FX markups, it loses to Wise on cost for international users.

The Bigger Strategy: Stripe as Complete Financial OS

Physical cards complete Stripe’s evolution from payment processor to full banking alternative:

| Service | Status | Launched |

|---|---|---|

| Payment processing | Core product | 2011 |

| Subscriptions & billing | Available | 2013 |

| Issuing (white-label cards) | Available | 2020 |

| Treasury (business banking) | Available | 2021 |

| Corporate cards (own brand) | Launching | 2025 (announced) |

| Business loans | Available (Capital) | 2019 |

With cards, Stripe merchants can accept payments, hold funds in Treasury accounts, spend via debit card, and access financing—all within one platform. This “closed-loop” ecosystem increases stickiness and reduces churn.

Who Wins and Who Loses

Winners

- Stripe merchants: Eliminate bank transfers to access Stripe funds

- Digital nomads: Spend earnings directly without Wise transfer delays

- International businesses: Competition forces both Stripe and Wise to improve fees/support

Losers

- Traditional business banking: Another reason to abandon legacy banks

- Mercury, Brex, Ramp: Fintech cards face stronger competition from embedded solution

- Wise (potentially): If Stripe matches FX rates and adds multi-currency, they lose differentiator

Expect these developments in 2026:

- Limited beta launch: Select merchants in US/UK/EU get early access Q1 2026

- Fee structure revealed: Pricing announcement sparks immediate Wise comparison debates

- Integration with Treasury: Cards automatically draw from Stripe Treasury balances

- Wise responds: Likely lowers fees or adds features (instant transfers, better Stripe integration)

- Multi-currency rollout: Stripe adds EUR, GBP, CAD, AUD balances and cards by late 2026

Stripe’s physical cards solve a genuine pain point: merchants earning revenue on Stripe currently can’t spend those funds without transferring to external banks or services like Wise. But success depends on three factors:

- Competitive pricing: FX fees must match or beat Wise’s transparent model

- International reach: Launch in 20+ countries simultaneously, not US-only

- Support quality: Match Wise’s highly-rated customer service, not maintain current gaps

As one user summarized: “Competition is always good!” For merchants, that competition means lower fees, better service, and more choices. Whether Stripe can dethrone Wise or simply force improvements across the industry, businesses win either way.