-1.70%

+1.67%

+1.36%

+0.00%

-3.67%

+5.86%

The crypto markets are experiencing a dynamic week, with XRP surging due to a new ETF, while Shiba Inu faces challenges in maintaining its market position. Simultaneously, a European central bank is cautiously exploring digital assets, potentially indicating a shift in institutional perspectives. This mixed landscape underscores the rapid evolution of the crypto space.

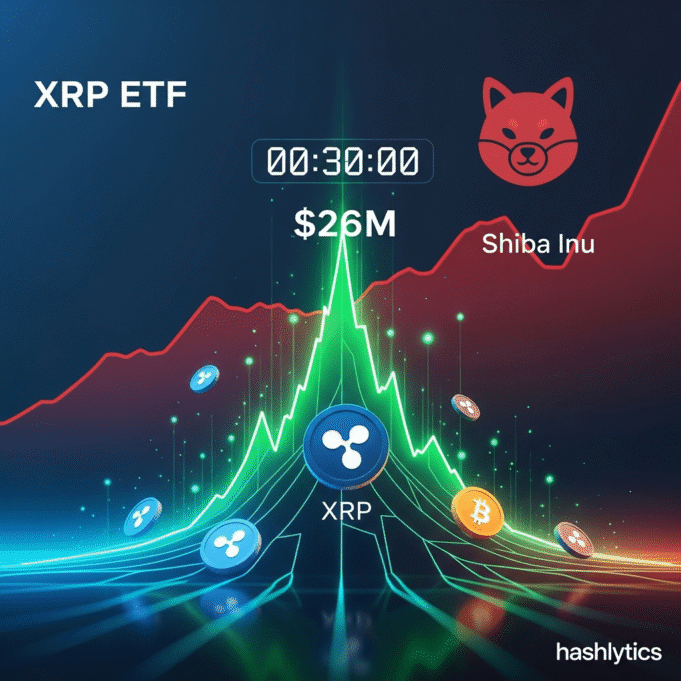

Canary‘s XRP ETF (XRPC) made a strong debut, achieving an impressive $26 million in trading volume within the first 30 minutes. This performance exceeded initial expectations, highlighting the continued demand for crypto exposure through traditional investment vehicles.

According to a post on X by Bloomberg’s senior ETF analyst, Eric Balchunas, XRPC surpassed initial projections of $17 million. At a price of $26.54 per share, approximately one million units were traded in the opening minutes. This successful launch emphasizes the significant demand for investment products related to XRP, especially following the resolution of its regulatory issues.

Behind the Numbers

The strong initial performance is likely attributable to several factors. Pre-launch anticipation played a crucial role, along with general market optimism surrounding XRP‘s future prospects. The resolution of the legal uncertainties that previously surrounded XRP has attracted investors who were previously hesitant to invest.

In contrast to XRP’s positive momentum, Shiba Inu (SHIB) is currently facing headwinds. The meme coin’s price has seen a decline, currently trading around $0.000009771, representing a 1.3% decrease on the day. This decline follows a period of sideways trading, leading to investor frustration.

SHIB has been range-bound since early 2023, struggling to surpass key resistance levels. The drop below the $0.00001 psychological threshold in late October further eroded investor confidence.

The prolonged consolidation reflects low volatility and intense competition from other meme coins. SHIB requires a significant catalyst to reignite interest and regain its previous momentum.

Signaling a potential shift in institutional sentiment, the Czech National Bank (CNB) has become the first central bank in the European Union to experiment with digital assets. The CNB has established a $1 million “test portfolio” that includes Bitcoin, U.S. dollar-pegged stablecoins, and a tokenized dollar deposit.

The CNB has clarified that this initiative is not an investment strategy or a change to its reserves. Rather, it is a controlled experiment designed to gain practical experience with blockchain-based assets. As the CNB explained, this purchase of $1 million Bitcoin is being framed as a controlled experiment, not an investment or a change to the Czech central bank’s reserves.

Central banks have traditionally avoided direct crypto holdings due to concerns about volatility and regulatory uncertainty. The CNB’s initiative represents a significant step, demonstrating a growing awareness of the importance of understanding and preparing for the future of finance.

These developments underscore the dynamic nature of the cryptocurrency market. While the launch of XRP’s ETF offers a positive sign for mainstream adoption, Shiba Inu’s struggles serve as a reminder of the inherent risks. The Czech National Bank’s experiment indicates that even traditionally conservative financial institutions are beginning to explore the potential of digital assets. This is a space to watch closely as the next chapter unfolds.