AWS, already the world’s leading cloud service provider, is rapidly evolving into Amazon‘s AI growth engine. This strategic pivot isn’t just about keeping pace with the tech landscape; it’s about dominating it. The implications for shareholders, and the broader AI market, are significant.

The hype around AI is real, fueled by the promise of unprecedented efficiency and innovation. Companies are scrambling to integrate AI into their operations, creating a massive demand for computing power and specialized tools. This is where AWS shines, positioning itself as the essential infrastructure provider for the AI revolution.

Like the savvy merchants who sold pickaxes and shovels during the California Gold Rush, Amazon is profiting handsomely from the AI boom by providing the underlying resources that every AI-driven enterprise needs. They’re not just building AI; they’re building the platform for AI.

AWS’s transformation into an AI hub is evident in its financial performance. The division boasts a staggering $132 billion annual revenue run rate, a testament to its existing dominance in the cloud market. More impressively, recent quarters have seen revenue growth accelerating, reaching a blistering 20% year-over-year – the fastest pace in nearly three years. This isn’t just incremental growth; it’s a surge fueled by AI demand.

Several factors contribute to AWS’s success as an AI growth engine:

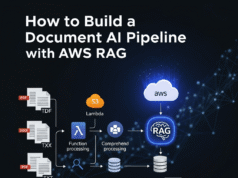

- Established Relationships: Many companies already rely on AWS for their cloud infrastructure, making it a natural choice for their AI needs.

- Comprehensive Solutions: AWS offers a vast array of AI-related products and services, from high-performance Nvidia chips to its own lower-cost alternatives.

- Managed Platforms: Services like Amazon Bedrock provide fully managed AI platforms, simplifying development and deployment.

Amazon’s CEO, Andy Jassy, has made it clear that the company is committed to aggressively investing in AI capacity. During a recent earnings call, he emphasized the strong demand and the company’s ability to monetize its investments as quickly as it adds capacity. This proactive approach suggests a long-term vision for AWS as the cornerstone of the AI landscape.

“You’re going to see us continue to be very aggressive in investing in capacity because we see the demand,” Jassy said during the latest earnings call. “As fast as we’re adding capacity right now, we’re monetizing it.”

This isn’t just about building more data centers; it’s about anticipating the future needs of AI developers and providing the tools and infrastructure they need to thrive. Amazon’s strategy is to make AI accessible and efficient for a wide range of customers, from startups to established enterprises.

In a market flooded with AI stocks, identifying true winners can be a challenge. However, Amazon’s AWS offers a compelling case as a relatively safe bet. The cloud giant is already generating substantial revenue from its AI investments, and its market leadership and diverse product offerings suggest that this momentum will continue.

Currently trading at a reasonable 32x forward earnings estimates, Amazon presents a compelling investment opportunity. By transforming its cloud business into a powerful AI growth engine, Amazon is positioning itself at the forefront of the next technological revolution. This is not just about e-commerce anymore; it’s about building the future of AI.