-0.96%

-0.80%

+3.10%

+1.18%

+1.83%

-0.02%

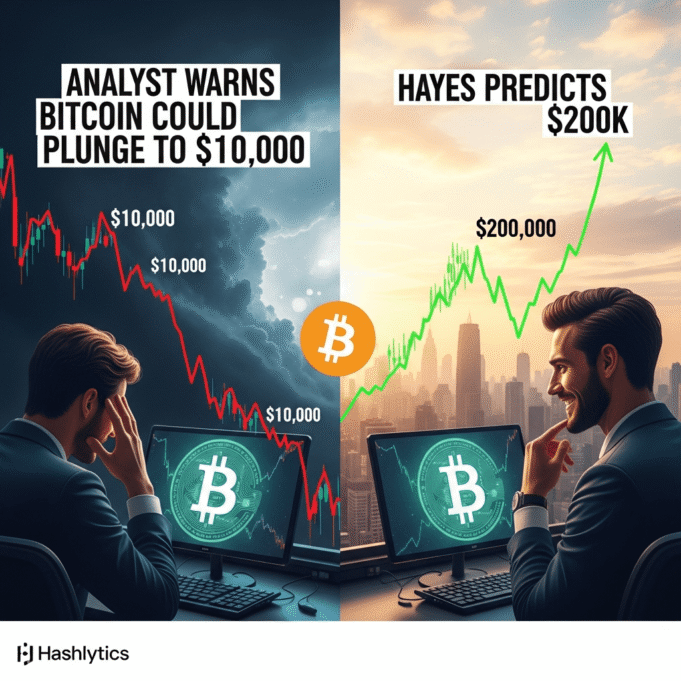

Contrasting Hayes’s forecast, another analyst has warned of a potential Bitcoin price crash to $10,000. This bearish outlook suggests significant downside risk for the cryptocurrency, highlighting the volatile nature of the market.

As of recent reports, Bitcoin is trading at $88,275, marking a 0.6% increase over the past 24 hours. Ethereum has also seen gains, rising by 1.6% to trade at $2,976.

Hayes’s prediction hinges on the U.S. Federal Reserve’s monetary policy. The anticipated $40 billion monthly liquidity injection is expected to stimulate the market and drive up the price of Bitcoin. This strategy aims to increase the availability of capital, potentially leading to greater investment in cryptocurrencies.

The contrasting predictions reflect the inherent volatility and uncertainty in the cryptocurrency market. Factors influencing these forecasts include regulatory developments, technological advancements, and macroeconomic conditions. The differing opinions among analysts underscore the challenges in predicting Bitcoin’s future price movements.

The specific identity of the analyst predicting a drop to $10,000 remains unknown. The exact factors that would trigger such a crash are also not specified.

The cryptocurrency market will likely continue to experience volatility as it responds to various economic and regulatory factors. Investors and enthusiasts will closely monitor the Federal Reserve’s actions and their impact on Bitcoin’s price. The performance of Bitcoin ETFs will also be a key indicator of market sentiment and investment trends.

Given the volatility of the cryptocurrency market, readers should:

- Conduct thorough research before making any investment decisions.

- Diversify their investment portfolios to mitigate risk.

- Stay informed about market trends and regulatory developments.

- Consider consulting with a financial advisor to assess their risk tolerance and investment goals.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates