+4.86%

+7.11%

+8.30%

+8.54%

-11.95%

+3.56%

In a cryptocurrency market often characterized by post-airdrop dumps, the BLESS token is defying expectations with a remarkable 250% surge that has caught the attention of both retail investors and institutional players. This explosive growth, which saw the token climb from $0.03 to over $0.08, represents a fascinating case study in how innovative utility and strong fundamentals can overcome typical market patterns.

Bless Token Surges 250%: Key Price Levels and Chart Analysis

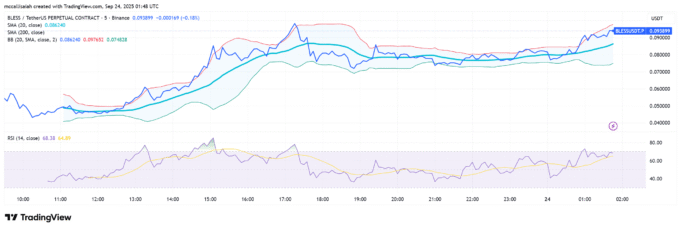

Technical analysis reveals an unusually robust price structure for a newly launched token. The 20-day moving average has established a reliable support level around $0.085, while resistance hovers between $0.097 and $0.10. What’s particularly noteworthy is the formation of a golden cross – a highly bullish technical indicator that occurs as the 20-day SMA crosses above the 200-day average.

Adding to the bullish case, the emerging cup-and-handle pattern suggests potential upside targets of $0.11-$0.12. This formation, typically associated with mature assets, indicates unusual stability for a new token.

Market data from CoinGecko shows daily trading volumes exceeding $200M – a level that puts BLESS in the company of established mid-cap cryptocurrencies. This robust trading activity suggests strong market interest beyond mere speculative trading.

Revolutionary Approach to Decentralized Computing

What sets BLESS apart is its innovative approach to disrupting the $1 trillion cloud computing market. Unlike traditional cloud services dominated by tech giants, Bless Network has created a unique “anti-cloud” solution that democratizes computing power through a simple browser extension.

The project’s $8 million funding round, backed by respected firms like NGC Ventures and M31 Capital, has enabled rapid development and user acquisition. With 6.3M nodes and 2.5M testnet users, Bless Network is demonstrating promising network effects that could challenge traditional cloud providers.

The token’s utility goes beyond speculation, with 90% of app revenue dedicated to token burns – a mechanism designed to create sustainable value appreciation. This approach addresses one of the key criticisms often leveled at utility tokens: the lack of genuine value accrual mechanisms.

Risk Factors and Future Outlook

While the project shows promise, investors should consider several risk factors. The crypto community has raised concerns about potential similarities to previous farming models that proved unsustainable. However, Bless’s focus on accessibility and real-world utility through its browser extension represents a significant evolution from these earlier models.

Looking ahead, Bless Network’s success will likely depend on its ability to deliver on its ambitious technical roadmap while maintaining security and decentralization. The project’s positioning as a bridge between Web2 and Web3 users could prove crucial for mainstream adoption.

For investors considering BLESS, key metrics to monitor include:

- Node growth rate and geographic distribution

- User retention metrics beyond initial airdrop claims

- Development of enterprise partnerships

- Technical implementation of promised features

As the decentralized computing space evolves, Bless Network’s approach of combining accessible technology with token-based incentives could serve as a template for future Web3 projects aiming to bridge the gap between traditional and decentralized services.