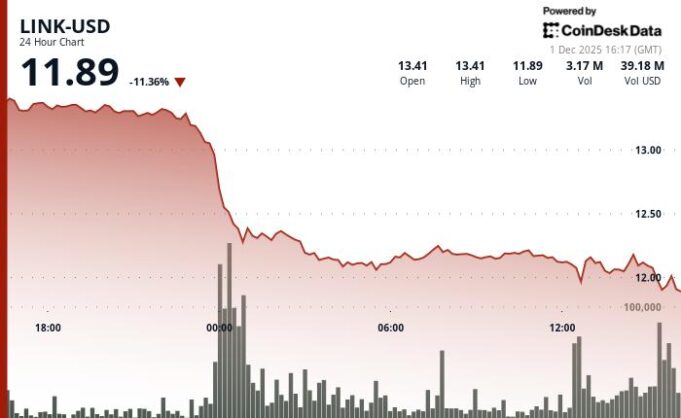

Chainlink‘s LINK token is currently experiencing a significant downturn. Despite optimism surrounding the potential for a spot ETF, the cryptocurrency has seen an 11% price decrease, falling below the $12 level as broader market concerns overshadow any positive ETF expectations.

This decline highlights that even the anticipation of mainstream acceptance cannot always protect altcoins from overall market sentiment. The question now is whether this is a temporary setback or indicative of deeper problems for the oracle network.

The expectation was that Grayscale’s initiative to convert its closed-end LINK trust into an ETF would act as a bullish catalyst. ETF analyst Nate Geraci even mentioned that the ETF could be listed on NYSE Arca this week. However, the market has not responded as anticipated.

This discrepancy underscores a key conflict: the market’s immediate emphasis on technical indicators and macroeconomic pressures versus the long-term opportunities unlocked by regulatory approval. It appears that traders were more focused on breaking support levels than on future possibilities.

A worrying breakdown was identified by CoinDesk Research’s technical analysis tool, as a rise in volume (280% above the daily average, reaching 7.14 million LINK) pushed the token below the crucial $13.00 support level. This was not a minor dip, but a clear rejection.

The price action presented a bearish outlook, with successive lower highs confirming the downward pressure. The token reached a low of $11.94, a level that should be concerning for Chainlink bulls.

Key Levels to Watch

Here are the key levels to monitor:

- Support/Resistance: Immediate support is now at $11.87, while resistance is forming at the previous breakdown point of $12.26.

- Volume Analysis: The 7.14M token volume spike indicates considerable institutional selling pressure.

- Chart Patterns: The break below the descending trendline resulted in an 11.7% drop across a $1.56 range, representing a substantial move.

- Targets and Risk: Further downside movement could target the $11.70–$11.80 zone, with November lows at $11.39 serving as the next critical level to watch.

LINK’s difficulties reflect the general risk-off sentiment in the cryptocurrency market. Bitcoin itself fell, nearing $64,000 during U.S. morning hours, due to macro anxieties and speculation surrounding a potential Bank of Japan rate hike.

This correlation emphasizes the interconnected nature of the crypto ecosystem. Even projects with robust fundamentals, such as Chainlink, can be affected by external factors and market-wide fear, uncertainty, and doubt (FUD).

The near-term outlook for LINK seems uncertain. The technical damage has been done, and the market remains focused on macroeconomic uncertainties. However, the long-term potential of Chainlink as a vital infrastructure provider for decentralized applications remains strong.

The coming weeks will be an important test of Chainlink’s resilience. Can it withstand the current challenges, strengthen its position, and ultimately benefit from the ETF narrative? Or will it succumb to bearish pressures and risk further declines? Only time will tell, but it’s clear that the path to mainstream adoption is rarely straightforward.