The cloud native technology market is about to explode, and we’re not talking about a minor software update. We’re talking a full-blown, $184 billion supernova by 2035.

That’s right, the era of monolithic applications is fading faster than dial-up internet, giving way to a world of microservices, containers, and DevOps magic.

Cloud Native Tech Market to Reach $184 Billion by 2035: A Forecast of Epic Proportions

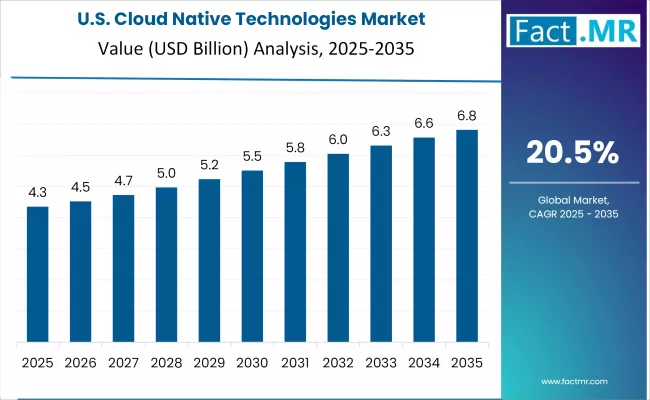

The numbers don’t lie. From a respectable $28.5 billion in 2025, the global cloud native technologies market is projected to skyrocket, adding a staggering $156.5 billion over the next decade. This isn’t just growth; it’s an outright digital revolution, fueled by the insatiable demand for scalable, agile, and efficient applications. The projected CAGR of 20.5% is enough to make any investor’s heart flutter, but what’s driving this meteoric rise?

Well, think about it. Businesses are under constant pressure to deliver better, faster, and more innovative solutions. Traditional development approaches simply can’t keep up.

Cloud native technologies, with their promise of 70-85% faster deployment times, are the nitrous boost that enterprises need to stay ahead of the competition. But it’s not all sunshine and rainbows. Migrating legacy applications can be a Herculean task, and the specialized skills required for cloud native development can be a significant barrier to entry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 28.5 billion |

| Market Forecast Value (2035) | USD 184.0 billion |

| Forecast CAGR (2025-2035) | 20.5% |

Despite these challenges, the momentum is undeniable.

The Platform Segment: King of the Cloud Native Hill

When it comes to cloud native technologies, the platform segment reigns supreme, commanding approximately 45.0% of the total market share in 2025. These aren’t your grandpa’s servers; we’re talking about sophisticated container orchestration systems, scalable infrastructure, and intelligent management tools that make application deployment a breeze. Kubernetes, the open-source container orchestration system, has become a cornerstone of modern cloud native strategies.

Its ability to automate deployment, scaling, and management of containerized applications is a game-changer for enterprises of all sizes. You can explore Kubernetes’ capabilities further on their official website.

But let’s not forget about the services segment, which holds a substantial 35.0% market share. These are the folks who provide the crucial support, deployment, and migration services that make the cloud native transition smoother than a freshly paved highway. And then there are the tools, capturing approximately 20.0% of the market, catering to development teams with specialized environments and automation needs. In short, it’s an ecosystem where platforms, services, and tools work in harmony to deliver cloud native nirvana.

Large enterprises are leading the charge, gobbling up around 65.0% of the market share in 2025. They’re the ones with the complex applications, the massive scalability demands, and the burning need for enterprise-grade container orchestration. But don’t count out the SMEs, capturing a respectable 35.0% market share.

They’re agile, they’re hungry, and they’re leveraging cloud solutions to punch way above their weight class. The cloud native revolution is democratizing innovation, empowering businesses of all sizes to compete on a level playing field.

Regional Rundown: Who’s Winning the Cloud Native Race?

The cloud native technologies market is a global phenomenon, with different regions taking the lead in different aspects of adoption and innovation. The United States is currently in the pole position, thanks to its robust cloud infrastructure and a culture of embracing cutting-edge technologies. Germany is hot on its heels, driven by its “Industry 4.0” initiatives and a strong focus on digital transformation.

The UK, with its thriving financial services sector, is also a major player, leveraging cloud native solutions to drive agility and innovation. Asia-Pacific is the region to watch, with China and India leading the charge, fueled by rapid cloud expansion and ambitious digital transformation programs.

Specific countries are showing impressive growth rates. The United States is projected to grow at a CAGR of 22.8% through 2035, driven by government-backed digital transformation programs and a comprehensive cloud technology ecosystem. Germany is expected to expand at a CAGR of 22.2%, fueled by its industrial development and increasing focus on digital transformation solutions.

The U.K. is maintaining a steady growth rate of 21.6%, thanks to its advanced financial services sector and a focus on fintech innovation. South Korea is demonstrating strong technology innovation, with a CAGR of 21.0%, driven by its integration with intelligent telecommunications systems and 5G technologies.

| Country | CAGR (2025-2035) |

|---|---|

| United States | 22.8% |

| Germany | 22.2% |

| U.K. | 21.6% |

| South Korea | 21.0% |

| Japan | 20.4% |

| France | 19.8% |

What about the challenges? High migration costs for legacy applications, a shortage of technical skills, and security concerns are potential speed bumps on the road to cloud native dominance. But the benefits – faster deployment, improved scalability, and enhanced agility – are simply too compelling to ignore. The cloud native revolution is here to stay, and it’s reshaping the future of software development.

The cloud native technologies market is a dynamic and rapidly evolving landscape. It’s a world of containers, microservices, and DevOps, where innovation is the name of the game. As organizations increasingly embrace cloud-first strategies, the demand for cloud native solutions will only continue to grow. The journey to the cloud is a transformative one, and the cloud native technologies market is paving the way for a future where applications are more scalable, agile, and resilient than ever before.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.5 Billion |

| Component | Platform, Services, Tools |

| Organization Size | Large Enterprises, SMEs |

| Industry | IT & Telecom, BFSI, Retail, Healthcare, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, U.K., South Korea, Japan, France, and 40+ countries |

| Key Companies Profiled | Amazon Web Services, Microsoft Corporation, Google LLC, IBM Corporation, VMware Inc., Red Hat Inc., Docker Inc., Kubernetes, Pivotal Software, Cloud Foundry Foundation |

| Additional Attributes | Dollar sales regional adoption trends across North America, Europe, and Asia Pacific, competitive landscape with cloud providers and technology integrators, enterprise facility requirements and specifications, integration with DevOps platforms and digital transformation initiatives, innovations in container technology and orchestration systems, and development of specialized applications with scalability accuracy and automation capabilities. |