-1.70%

+1.67%

+0.37%

-1.03%

-3.32%

+0.39%

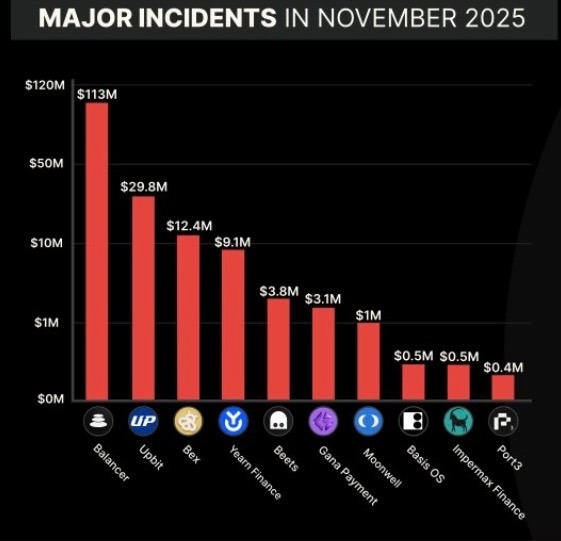

November 2025 will be remembered as a month of relentless attacks on the DeFi space. CertiK Alert, a blockchain security firm, documented over ten major incidents, highlighting a disturbing trend of escalating sophistication and financial impact.

Two attacks stand out for their sheer scale: Balancer, a popular automated market maker, suffered a loss of $113 million, while the South Korean exchange Upbit saw $29 million vanish from its coffers. These figures paint a grim picture of the vulnerabilities plaguing even well-established platforms.

Vitalik’s caution

Ethereum’s core developers, led by Vitalik Buterin, are championing enhanced privacy, decentralization, and security as crucial elements for fostering mainstream adoption of digital assets. Buterin has cautioned crypto users against placing blind faith in Web3 developers who prioritize centralization for perceived gains in service quality.

“Crypto users must not trust web3 developers seeking to centralize their systems in the name of enhanced services,” Buterin argues.

Essentially, Buterin believes that reducing centralization is paramount to eliminating single points of failure and mitigating risk.

The industry must prioritize robust code audits, formal verification techniques, and bug bounty programs to identify and address vulnerabilities before they can be exploited. The future of DeFi hinges on building a more secure and resilient ecosystem.

As the DeFi landscape continues to evolve, the battle between innovators and exploiters will undoubtedly intensify. Only through a concerted effort to prioritize security and decentralization can the industry hope to realize its full potential and build a truly trustworthy financial system.