These figures, first reported by Zitron, offer a rare glimpse inside the notoriously secretive AI powerhouse, hinting at both its impressive revenue generation and equally impressive operational expenses.

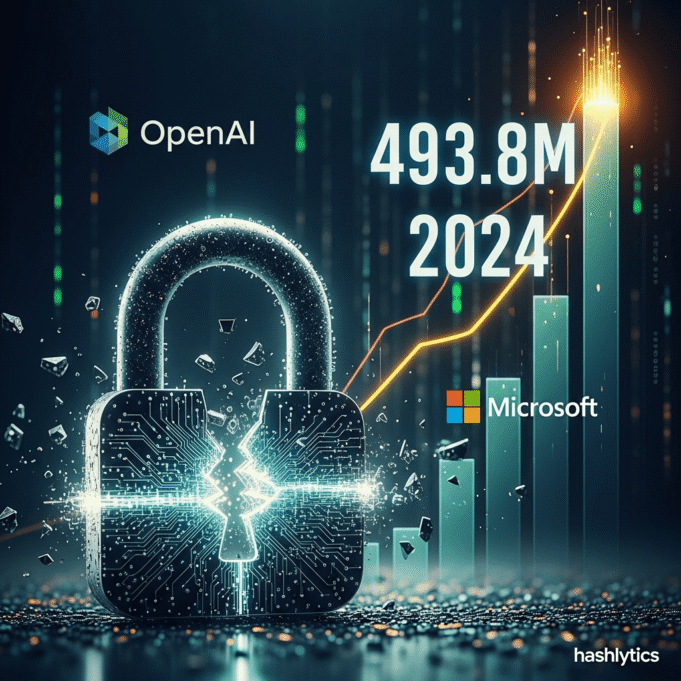

Microsoft’s deep pockets have been instrumental in OpenAI’s rapid ascent. As part of their multi-billion dollar investment — over $13 billion, according to reports — Microsoft receives a percentage of OpenAI’s revenue, allegedly around 20%. The leaked data confirms that this amounted to nearly half a billion dollars in 2024 alone. In the first three quarters of 2025, that number jumped to $865.8 million, according to documents viewed by Zitron reported this week.

But the revenue sharing is a two-way street. Microsoft also kicks back roughly 20% of the revenues from Bing and Azure OpenAI Service to OpenAI. This creates a complex financial relationship that’s difficult to fully untangle from the outside.

According to a TechCrunch source, the $493.8 million figure represents Microsoft’s net revenue share, meaning it excludes what Microsoft already paid OpenAI from Bing and Azure OpenAI royalties. This adds another layer of complexity to the already opaque financial picture.

While Microsoft doesn’t publicly break out the revenue generated from Bing and Azure OpenAI, the leaked documents allow us to infer some key figures. Based on the reported 20% revenue share, OpenAI’s revenue was at least $2.5 billion in 2024 and potentially much higher. Some reports, like those from The Information, have pegged OpenAI’s 2024 revenue closer to $4 billion, with $4.3 billion in the first half of 2025. OpenAI’s 2024 revenue is estimated at around $4 billion, and its revenue from the first half of 2025 at $4.3 billion .

Sam Altman himself has fueled the speculation, claiming OpenAI’s revenue is “well more” than $13 billion a year and projecting a staggering $100 billion by 2027. $13 billion a year , will end the year above $20 billion in annualized revenue run rate (which is a projection, not guidance on actual revenue), and that the company could even hit $100 billion by 2027.

However, the leaked data also reveals eye-watering inference costs—the compute required to actually run the AI models and generate responses. Zitron’s analysis suggests OpenAI may have spent roughly $3.8 billion on inference in 2024, skyrocketing to $8.65 billion in the first nine months of 2025.

The Inference Inferno

These figures paint a concerning picture. If OpenAI is indeed spending more on inference than it’s earning in revenue, it raises serious questions about the long-term sustainability of its business model. Previous reports put OpenAI’s entire compute spend at roughly $5.6 billion for 2024 and its “cost of revenue” at $2.5 billion for the first half of 2025.

- Inference costs are largely paid in cash, unlike training costs, which are often non-cash.

- OpenAI has historically relied heavily on Microsoft Azure for compute, but is diversifying to other providers like CoreWeave, Oracle, AWS, and Google Cloud.

The leaked data throws fuel on the already raging debate about an AI bubble. If OpenAI, the undisputed leader in the field, is struggling to turn a profit, what does that mean for the hundreds of other AI startups chasing inflated valuations? The implications could be significant, potentially triggering a market correction and forcing investors to re-evaluate the true value of AI-driven companies.

Both OpenAI and Microsoft declined to comment on the leaked data, leaving the industry to speculate about the true state of affairs behind the AI curtain.

The AI revolution is undoubtedly underway, but the leaked OpenAI data serves as a stark reminder that even the most groundbreaking technologies must eventually face the cold, hard reality of profitability. As the AI landscape matures, expect increased scrutiny on financial performance and a shift towards sustainable business models—or risk becoming another casualty of the hype cycle.