-1.70%

+1.67%

-0.05%

+1.02%

+2.26%

+0.00%

The cryptocurrency market has witnessed extraordinary volatility with meme coins like $MELANIA, reflecting the speculative and unpredictable nature of digital asset trading. Market aggregators documented a dramatic price trajectory for the $MELANIA token, with values rocketing to $13.73 before dramatically plummeting to around $0.10. Parallel token $TRUMP experienced similar volatility, peaking at $45.47 and later trading near $5.79, according to CoinMarketCap.

Historical analysis of similar meme coin projects reveals consistent patterns of extreme price volatility. The lifecycle typically involves an initial surge driven by speculation and social media hype, followed by rapid value erosion as early investors seek to cash out. Blockchain analytics firms have documented numerous instances where such tokens experience price movements that can exceed 500% within hours, highlighting the speculative nature of these digital assets.

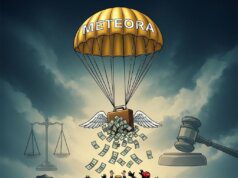

The legal landscape surrounding cryptocurrency trading continues to evolve, with regulatory bodies increasingly scrutinizing unconventional token launches and trading practices. This lawsuit represents a growing trend of legal challenges targeting potentially manipulative cryptocurrency market behaviors.

Key Investor Watchpoints

- Detailed examination of public court filings

- Tracking on-chain wallet transactions

- Monitoring exchange compliance disclosures

- Analyzing token distribution and ownership patterns

- Evaluating marketing claims and promotional strategies

Forensic blockchain analysis has become crucial in investigating potential market manipulation. Advanced tracking technologies now allow investigators to trace token movements, identify suspicious trading patterns, and assess the legitimacy of cryptocurrency transactions with unprecedented precision.

Cryptocurrency regulation represents a complex and evolving legal landscape. Regulatory agencies are increasingly concerned with protecting investors from potentially fraudulent token offerings. The SEC has historically emphasized that many meme coins could be classified as securities, subject to strict disclosure and registration requirements.

Emerging evidence suggests connections to broader money laundering investigations, underscoring the complex risk landscape in cryptocurrency markets. Financial intelligence units worldwide have heightened their monitoring of cryptocurrency transactions, recognizing the potential for digital tokens to facilitate illicit financial activities.

- Rigorously verify information sources

- Carefully review smart contract architectures

- Maintain skepticism toward sensationalized marketing

- Understand token economics and distribution mechanisms

- Assess the credibility of project developers and advisors

Academic research increasingly highlights the importance of investor education in emerging digital asset markets. Universities and financial institutions are developing specialized programs to help investors navigate the complex and rapidly evolving cryptocurrency ecosystem.

In an environment marked by rapid speculation and regulatory uncertainty, informed caution remains an investor’s best strategy. The $MELANIA token exemplifies the broader challenges and risks inherent in speculative cryptocurrency markets, underscoring the need for comprehensive research and measured investment approaches.