-1.70%

+1.67%

+0.56%

-1.03%

+2.26%

-1.05%

XRP‘s recent inability to decisively overcome the $2.10 resistance level has put traders on alert, particularly as Bitcoin ETF flows experience surges that subtly influence the crypto landscape. XRP’s repeated failures to break through this price ceiling, combined with intriguing supply dynamics, create a complex situation that warrants careful analysis.

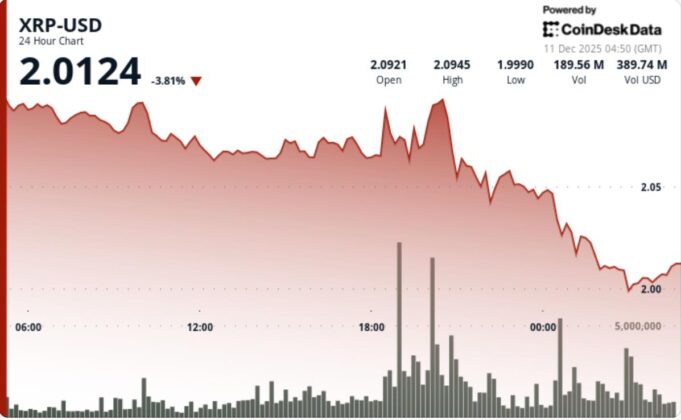

The latest rejection saw XRP decline from $2.09 to the $2.00 psychological support level, a 4.3% decrease. This underperformed the broader crypto market by a full percentage point. Understanding the reasons behind this divergence is critical to assessing XRP’s short-term trajectory.

The sell-off was significant. A massive volume spike of 172.8 million, exceeding the daily average by 205%, occurred precisely as XRP reached $2.08. This aggressive selling pressure suggests potential institutional distribution at a key resistance zone, not just retail activity.

Volume during the session was 54% above the 7-day average, a classic sign of institutions strategically reducing their holdings above a price barrier rather than panic selling. Market makers had previously indicated rising distribution pressure, noting substantial offers around the $2.10 mark.

Despite the price action, U.S. spot XRP ETFs have been steadily accumulating assets, attracting over $170 million in weekly inflows with no outflows. This consistent demand is compressing supply, even as the spot price struggles to sustain breakout momentum.

Over the past 60 days, exchange balances have decreased from 3.95 billion to 2.6 billion tokens. This shrinking supply, coupled with persistent ETF demand, is creating an increasingly asymmetric risk profile. Should the selling pressure decrease, XRP could be well-positioned for a significant upward movement.

The following points outline key observations from the charts:

Key Support and Resistance Levels

Support

The $2.00 level acts as the immediate line of defense. A break below this level could lead to a rapid decline toward a softer support zone around $1.95, which aligns with previous demand clusters.

Resistance

The $2.09–$2.10 band remains the primary obstacle. A sustained close above $2.10 would likely shift the short-term outlook to bullish.

Volume and Price Patterns

Volume

The volume spike during the rejection confirms the presence of strong sellers defending the $2.10 level.

Pattern

XRP is currently contained within a multi-month triangular compression pattern. Price action remains range-bound, with no confirmed breakout or breakdown.

Momentum

Momentum

Short-term momentum is currently skewed bearish following the clear rejection. Bounce attempts capped below $2.08 on declining volume indicate weak follow-through.

Traders should monitor the following factors:

- Can $2.00 hold as support? A clear break below this level exposes a potential fast move toward $1.95.

- Will ETF inflows continue? Any slowdown in inflows could remove a key support level.

- Can XRP break resistance? A breakout requires multiple hourly closes above $2.10 with sustained volume exceeding 100M.

- Is the compression pattern tightening? A tighter compression pattern suggests that the next move will be more significant than the last.

- Will the exchange balance continue to drop? Reduced supply can lead to faster price swings once a direction is confirmed.

XRP’s current situation reflects the conflict between spot market selling pressure and the underlying demand driven by ETF inflows. While the short-term outlook appears bearish, the decreasing exchange supply and consistent ETF support suggest a constructive long-term picture. The next major price movement is likely to be decisive.

Follow us on Bluesky , LinkedIn , and X to Get Instant Updates