-1.70%

+1.67%

-0.28%

+0.37%

+2.65%

-0.56%

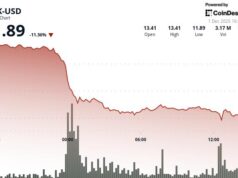

Chainlink announced January 20, 2026 the launch of 24/5 U.S. Equities Streams, bringing continuous market data for stocks and ETFs to DeFi platforms covering pre-market, regular, after-hours, and overnight trading sessions. The oracle network simultaneously revealed Chainlink Confidential Compute, a breakthrough privacy service enabling private smart contracts across any blockchain while maintaining verifiability—addressing the primary barrier to institutional adoption of onchain finance.

24/5 Equities Streams: Always-On Stock Market Data

For the first time, DeFi protocols gain secure access to U.S. equity market data beyond standard 9:30 AM-4:00 PM EST trading hours, unlocking the approximately $80 trillion U.S. stock market for onchain applications. According to Markets Media, the streams deliver fast, secure market data 24 hours per day, 5 days per week across more than 40 blockchains using Chainlink’s Data Standard.

The feeds provide comprehensive market context beyond simple price points, including bid and ask prices with volumes, last traded prices, market status flags indicating session type, staleness indicators for data freshness, and mid-price calculations. This complete data set enables protocols to build robust risk controls, safer liquidations, and consistent user experiences during off-hours trading when liquidity thins.

Chainlink built these streams using a “pull” model that delivers sub-second updates when trades occur rather than flooding networks with constant updates during quiet periods. According to Asset Servicing Times, this approach reduces network gas costs while maintaining the rapid pricing updates needed for derivatives and perps trading.

Early Adopters Building 24/7 Equity Markets

Major derivatives platforms have already integrated 24/5 U.S. Equities Streams. Lighter, the second-largest perpetuals DEX by volume, expanded its partnership with Chainlink to power equity perps that trade beyond regular market hours. CEO Vladimir Novakovski stated the streams enable “fair, low-latency perp execution beyond regular market hours without compromising data integrity.”

BitMEX, the inventor of crypto perpetual futures, adopted the feeds to offer professional-grade 24/7 equity derivatives infrastructure. CEO Stephan Lutz emphasized that “for derivatives markets, security and data integrity matter more than anything. Chainlink’s 24/5 US Equities Streams are a critical component of our professional-grade infrastructure.” ApeX, HelloTrade, Decibel, Monaco, Opinion Labs, and Orderly Network have also integrated the streams.

| Use Case | Description | Market Size |

|---|---|---|

| Equity Perpetuals | 24/7 leveraged trading on stocks/ETFs | Existing crypto perps: $200B+ |

| Prediction Markets | Betting on stock price movements | Growing rapidly post-2024 |

| Synthetic Stocks | Tokenized exposure without custody | Part of $30T RWA by 2030 |

| Lending Protocols | Stock-backed collateral | DeFi lending: $50B TVL |

Solving the Structural Mismatch

Blockchain operates continuously 24/7/365 while U.S. equity markets trade across fragmented sessions during dedicated hours. Most onchain data solutions only provided single price points during standard hours, creating pricing blind spots that increased risk during off-hours and made it difficult to build secure, scalable equity products onchain.

Chainlink 24/5 Streams transforms fragmented equity market data into continuous, cryptographically signed data streams verified through the Chainlink Data Standard—infrastructure that has enabled over $27 trillion in transaction value and delivered more than 19 billion verified messages onchain. Johann Eid, Chief Business Officer at Chainlink Labs, called this “a major step toward always-on, cross-border capital markets, and a foundational upgrade to how global equity markets operate.”

Coordination With Traditional Infrastructure

Chainlink collaborates with Swift, Euroclear, and the Depository Trust & Clearing Corporation (DTCC) to automate corporate actions including dividends and stock splits. This infrastructure ensures tokenized assets reflect key changes to underlying equities without manual intervention, addressing one of the operational challenges that previously limited institutional adoption of tokenized securities.

Confidential Compute: Privacy for Institutional Finance

Announced in November 2025 for early access release in early 2026, Chainlink Confidential Compute solves blockchain’s privacy-transparency paradox. The service enables private smart contracts that connect to real-world financial data and Web2 systems while keeping proprietary data, business logic, external connectivity, and computation fully confidential. According to Chainlink’s technical blog, lack of privacy represents the greatest barrier holding back large-scale institutional adoption of onchain finance.

The architecture combines trusted execution environments (TEEs) with threshold encryption and decentralized verification through oracle networks. Legal analysis from Bulldog Law notes that over 80% of global financial activity occurs in private, confidential settings, yet blockchain’s public nature has historically excluded such workflows from onchain systems.

Unlocking Institutional Use Cases

Confidential Compute enables previously impossible onchain applications for institutions. Private transactions conceal transaction details so positions remain confidential. Privacy-preserving tokenization brings institutional real-world assets like bonds, private credit pools, and fund allocations onchain without exposing investor information, deal sizes, or pricing terms. Confidential data distribution allows monetization of proprietary data like benchmark indices and valuations to approved subscribers only. Privacy-preserving cross-chain interoperability executes Delivery vs. Payment (DvP) settlement where tokenized assets and stablecoins exist on different chains. Privacy-preserving identity and compliance proves compliance using existing providers without revealing personal or institutional data onchain.

The service operates through the Chainlink Runtime Environment (CRE), an orchestration layer that went live in November 2025. Major institutions including UBS Asset Management (which manages over $6 trillion), Kinexys by J.P. Morgan, and Ondo Finance have already deployed CRE-powered workflows. According to institutional blockchain analysis, the RWA tokenization market grew 240% in 2025 to $18.5 billion, with 60% of institutional investors prioritizing privacy-ready infrastructure.

Technical Architecture

Confidential Compute builds on Chainlink Labs’ years of cryptographic research including Town Crier, DECO, and other privacy innovations. The system processes private contract conditions off-chain within trusted execution environments, then reports verified results back to blockchains using zero-knowledge proofs that confirm outcomes without revealing underlying data. Future expansions will incorporate fully homomorphic encryption and quantum-resistant techniques.

Chainlink founder Sergey Nazarov stated this mechanism ensures trust for users, regulators, and counterparties while enabling smart contracts that require privacy by design—a capability many financial contracts depend on that was previously unavailable in public blockchain environments.

Market Trajectory and Competitive Landscape

Privacy-preserving blockchain infrastructure is projected to grow at 38.36% CAGR, potentially reaching $15.06 billion by 2030 according to market research. The broader tokenization opportunity that CRE targets represents $867 trillion across real-world assets, stablecoins, and onchain DvP settlement. Chainlink’s oracle dominance—securing approximately 70% of oracle-related DeFi according to the company—positions it as a key enabler for institutional tokenization adoption.

The 24/5 Equities Streams launch coincides with NYSE’s separate announcement to develop a platform for tokenized U.S. equities and ETFs supporting 24/7 trading. While NYSE builds trading venues, Chainlink provides the verified data infrastructure those venues require—complementary developments accelerating the convergence of traditional finance and blockchain technology.

Binance founder CZ called Chainlink’s equities platform announcement “bullish for crypto and crypto exchanges,” recognizing the validation traditional asset integration brings to blockchain infrastructure. The combination of always-on data streams and privacy-preserving compute represents foundational infrastructure for the next wave of institutional onchain adoption.

Follow us on Bluesky, LinkedIn, and X to Get Instant Updates